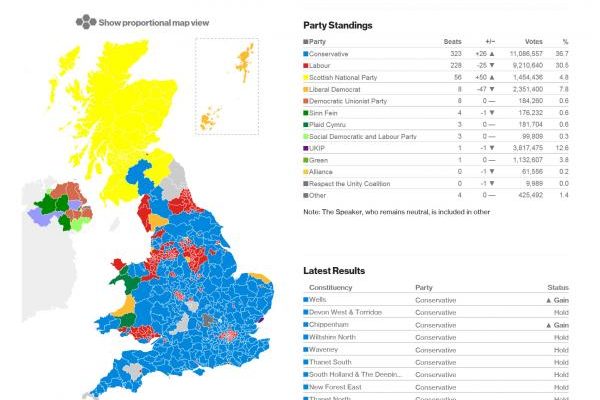

While the US is waking up in anticipation of what is once again said to be the “most important nonfarm payrolls number” at least since the last most important such number, because anything 250,000 and above puts the June rate hike right back on the Fed calendar, while a collapse in this lagging indicator will be explained away with harsh rain showers in April, and send stocks soaring (not to mention the 10Y promptly back under 2%) due to yet another delay in tightening expectations despite Yellen’s outright warning of overvalued stocks, the UK has been up all night following a dramatic election, whose outcome has been largely the opposite of what the experts predicted, with Conservatives set to win an outright majority, resulting in embarrassment for Labor, the Liberal Democrats and the UKIP, both of which have already seen dramatic changes in their leadership, and moments ago all three leaders, Miliband, Clegg and Farage announced they would stand down as party leaders.

The biggest losers so far:

BREAKING: U.K. Independence Party leader Nigel Farage resigns after being defeated in Parliament race

— The Associated Press (@AP) May 8, 2015

Live now: Nick Clegg holds news conference where he is expected to resign as Lib Dem leader http://t.co/eXyXVSvVsB

— BBC Breaking News (@BBCBreaking) May 8, 2015

#BREAKING Ed Miliband concedes defeat and steps down as UK opposition leader

— Agence France-Presse (@AFP) May 8, 2015

Â

As noted previously, the conservative victory is unleashed a risk on mode for UK assets, and has sent both cable and the FTSE higher on what were ubiquotous expectations of outcomes that were only negative for risk, once again confirming that the so-called experted usually have no idea what they are talking about.

To summarize, the Conservative Party look set to retain their grip on Parliament as they unexpectedly gained a majority in Parliament bolstering UK assets, especially the FTSE 100 (+1.7), as it outperforms continental Europe (Eurostoxx50 +0.6%). A long list of sectors including UK financials, gambling names, homebuilders have been supported by the Conservative victory, with utilities the best performing in Europe as this was the sector that was widely expected to be the worst hit if the Labour Party did come into power. Elsewhere, the upside in the FTSE has filtered through to European stocks which sits in mild positive territory. Syngenta (+17%) are among the best performing stocks in Europe following the approach from US listed company Monsanto for CHF 449/shr, which was later rejected.

In fixed income markets, a relief rally took place in Gilts (+81 ticks) lifting Bunds (+16 ticks) in sympathy, and saw UK paper trade open higher by over 150 ticks in reaction to the results of the UK election however, Gilts have since pulled off best levels following a bout of profit taking. This now opens the door for foreign investment as short-term uncertainty has abated which has attributed to the upside in Gilts. Moreover, analysts at UBS said that there will be a relief rally in UK markets in the short term, however warned that ongoing fears of a Brexit will soon present themselves. Furthermore, analysts at Deutsche Bank suggest that despite the premise of an EU referendum in 2017, it is not expected for investors to focus on this in the short term.

In FX markets, GBP/USD surged to its highest level since February 26th overnight and printed its largest move since 2009 after reports began to emerge that the Conservative could have a majority, although GBP/USD has pared back some of the move higher. Elsewhere, the USD-index (0.00%) trades flat heading into today’s release of Non-Farm Payrolls which is expected to pick-up from last month poor figure of 126K.

Overnight, AUD/USD was weighed on by the Chinese trade data and the latest quarterly SOMP from the RBA. The bank cut CPI and GDP forecasts, as expected, but struck a sombre tone on the economy in comparison to Tuesday’s decision. They noted that non-mining investment pick-up was unlikely in the next year and unemployment rate is to stay elevated for longer. Further moves lower in AUD/USD were capped by the 100 DMA at 0.7860, prompting a pullback in the pair to trade flat heading into the North American crossover.