After the worst week for stocks in years, and following a significantly oversold condition, it will hardly come as a surprise that the mean reversion algos (if only to the upside), as well as the markets themselves (derivative trading on the NYSE Euronext decided to break early this morning just to give some more comfort that excessive selling would not be tolerated)Â are doing all they can to ramp equities around the globe, and futures in the US as high as possible on as little as possible volume. And sure enough, having traded with a modestly bullish bias overnight and rising back over 2000, the E-Mini has seen the now traditional low volume spike in the last few minutes, pushing it up over 15 points with the expectation being that the generic algo ramp in USDJPY ahead of the US open should allow futures to begin today’s regular session solidly in the green, even if it is unclear if the modest rebound in the dollar and crude will sustain, or – like on every day in the past week – roll over quickly after the open. Also, we hope someone at Liberty 33 tells the 10Y that futures are soaring: at 2.13% the 10Y is pricing in nothing but bad economic news as far as the eye can see.

Speaking on oil, Brent gained more than $1, after earlier dropping to lowest since July 13, 2009. There was some bullish sentiment when Libya declared force majeure at oil ports, although that will hardly last once algos process that the combined capacity that is offline is a paltry 580k b/d capacity. WTI trades ~$58.50, climbs more $2 also off 5-yr low, on the same “catalyst.” Expect both fading as the realization that OPECisn’t kidding about $40 barrel oil filters through.

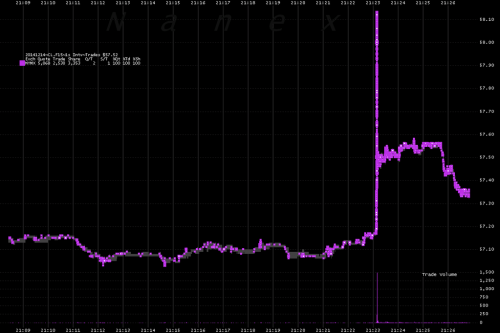

Finally, as we showed last night, this is what, via Nanex, a direct intervention to push crude higher – because central banks finally realized that plunging oil may be “unambiguously good” for the economy but is increasingly bad for markets – looks like: presenting the well-known “flash smash”, coming to every central-bank traded asset class near you.

Otherwise, as Ransquawk summarizes, in a relatively subdued morning, European equities start the week in positive territory after being buoyed by the energy sector following the slight bounce back in energy prices after falling below July 2009 levels at USD 58.32. This move comes despite earlier comments from UAE Energy Minister stating that ‘OPEC will stand by its decision not to cut crude oil even if oil prices fall as low as USD 40/bbl and will wait three months before an emergency meeting.’ In fixed income, the lack of pertinent macro news has failed to give Bunds much in the way of sustained direction, although they trade in negative territory with volumes exceedingly thin. Elsewhere, the Greek spread has seen a modest bout of tightening in a minor pullback of last week’s substantial widening following news that, according to weekend polls, the lead of the Greece opposition Syriza party over the ruling coalition has shrunk to 2.8-3.6% from about 4% a month ago.

US NEWS

US Senate passed the USD 1.1trl spending bill on Saturday night, sending it to President Obama for his signature. (BBG) Russia will take counter measures if the US imposes new sanctions over the Ukraine crisis, according to Russian Deputy Foreign Minister Ryabkov. (Interfax)

ASIA WRAP

Asian equities started the week on the back-foot following Friday’s sharp sell-off on Wall Street, which saw the S&P 500 and DJIA post its biggest weekly losses since May 2012 and Sep 2011 respectively. Nikkei 225 (-1.57%) was weighed on by JPY strength benefiting from flight to safety, with the index earlier touching its lowest level since Nov. 17. Shanghai Comp (+0.52%) remains firmly in the red, while Hang Seng (-0.95%) is on course for a 2-month low, weighed on by weakness in energy stocks.

FX

In FX markets, USD/JPY swung over 100 pips, initially opening above 119.00, following reports of a landslide victory for Japan PM Abe in the by-elections, before tumbling to 117.78 led by carry-trade unwinds and semi-official price keeping operations. Elsewhere, AUD saw a minor spell of weakness following reports of an ongoing hostage situation in a café 10 meters away from the RBA. This situation is still ongoing and we will continue to update listeners on the situation.