Today we get a two-for-one algo kneejerk special, first with the Q1 GDP release due out at 8:30 am which will confirm that for the second year in a row the US economy barely grew (or maybe contracted depending on the Obamacare contribution) in the first quarter, followed by the last pre-June FOMC statement, in which we will find out whether Janet Yellen and her entourage of central planning academics will blame the recent weakness on the weather and West Coast port strikes and proceed with their plan of hiking rates in June (or September, though unclear which year), just so they can push the economy into a full blown recession and launch QE4.

This is how Deutsche Bank previews today’s macroeconomic twofer:

By tonight we should have a lot more to talk about with regards to the US economy and the Fed as we see the first estimate of Q1 GDP and the FOMC conclusion. As we discussed earlier in the week the consensus for growth is 1% with DB now at 0.7% and the Atlanta Fed GDPNow at 0.1%. While we think some of the likely weakness is temporary we still believe that the US will continue to struggle to get close to its former trend rate of growth as far as the eye can see. That’s partly due to sympathy with secular stagnation views and partly due to global weakness combined with a stronger dollar in a beggar thy neighbour world. We don’t think the Fed shares this view so the FOMC statement (no press conference) will be interesting as to how much they put recent weakness down to transitory factors. DB’s Peter Hooper expects that the Fed will leave the door open for a June hike but sound balanced enough to leave market expectations for a rate hike by December (with high probability) if not September in place. However our read on this is that it leaves plenty of the time for the data to go either way so although we’ll learn a lot about their thoughts on the recent weakness, the reality is that data will blow everything out of the water over the coming months.

Speaking of more QE, while hardly noticed in the US, overnight the Bank of Thailand shot a few rounds in the global currency war when it cut rates unexpectedly from 1.75% to 1.50%, followed by the Swedish Riksbank, which kept rates on hold at a negative 0.25%, however boosted its own QE by SEK40-50 billion as yet another bank tries to outpace its competitors in the race to the currency devaluation bottom.

Also overnight we got a German Bund auction which was once again technically an “uncovered” failure with just €3.65 billion in bids for a €4 billion issue, not helped when stops were tripped to the downside earlier, blowing out by a whopping 8 bps, and touching as much as 0.24% following news yesterday that Gundlach was joining Gross in shorting the German Treasury.

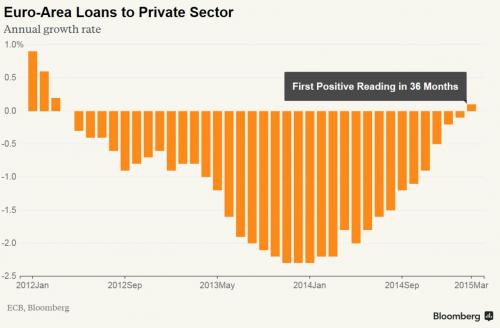

But perhaps the biggest catalyst for the selloff in the government complex as well as the jump in the EURUSD above 1.10 for the first time in three weeks is that for the first time in three years, lending by Euro-area banks to companies and households rose, which according to Bloomberg is “a sign that record monetary stimulus is finally reaching the economy.”

Â

From Bloomberg:

Bank lending increased 0.1 percent in March from a year earlier, the ECB said in a statement on Wednesday. Loans had posted annual declines in every month since May 2012. Lending climbed 0.2 percent from February.

“With its more aggressive stance, the ECB is finally bringing the euro zone back to at least trend growth,†said Holger Schmieding, chief economist at Berenberg Bank in London. “Money and credit point to a firming business cycle.â€

Of course, while one can be skeptical about these numbers and ask just how many of the trillions in NPLs had to be netted out of the calculation, the risk for the liquidity addicts is that loan creation will surge in the coming months and thus force the ECB to halt QE prematurely. As a reminder, commercial bank loan creation has been the all critical missing link from the European recovery.

Then again, Europe did “represent” a loan recovery in early 2012 before the latest credit dead cat bounce faded just as fast.