Despite last night’s Nikkei futures smash, in the hours that immediately followed, algos had an easy time levitating both European stocks and US futures on the usual no volume, until suddenly, a little after the European open, the European commission released an Easter egg when it finally admitted, with less than 2 months left in the year, that a European triple dip is in the card, when it slashed its May growth and inflation forecasts across the board for not only Europe but the rest of the world as well.

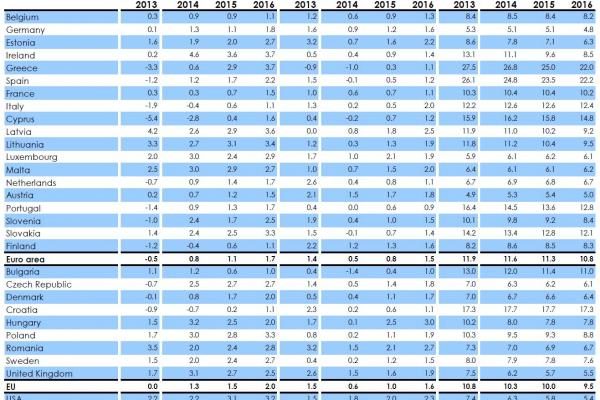

The commission said it now expects gross domestic product in the 18-country Eurozone to grow 0.8% this year, down from 1.2% growth it forecast this spring. In 2015, the eurozone economy will likely grow 1.1%, also less than the 1.7% growth seen in the spring. In 2016, growth in the currency union will rise to 1.7%, the commission said, as the WSJ summarized. Needless to say this latest set of expectations by Jean-Claude “You have to lie” Juncker, will also be severely over-optimstic, and we eagerly look ahead to 2015 growth being slashed to negative at the next EC growth revision in six months.

Yet what is strange is that while traditionally such a major downward growth revision would have been sufficient to send futures soaring – why: because in a world where only central banks are left, it means more central bank global bailouts of course – this time the adverse update actually had the impact of sending futures to their lows of the session, granted just a few tiny points since the market is clearly disconnected with even the most pro forma, non-GAAP version of reality, but the reaction direction was clearly unexpected.

Perhaps this is explained by the ongoing devastation in both WTI and Brent, which were trading at $76.70 and $82.50 at last check, both down almost 3% as the plan to use Saudi Arabia to crush Russia has instead backfired and the Saudi princes are now openly looking at destroying the US shale infrastructure, as we forecast in the worst, for Obama, scenario.

So looking at fixed income and equity markets, European equities enter the North American open, mostly in negative territory as participants shrug off initial BoJ-inspired gains, with attention instead turning towards the EU Commission who cut their Euro-Area growth and inflation forecasts for 2014 and 2015. The continuation of the slide seen in WTI prices has placed further heavy pressure on energy-related names, with the energy-heavy FTSE 100 being squeezed as a result. In terms of this morning’s earnings reports, they painted a relatively mixed picture with the notable outlier Hugo Boss (-5.7%) after they cut their FY forecasts. On an index specific basis, the FTSE MIB leads the way for Europe, with Banca Monte dei Paschi (+12.2%) higher after NIT Holding Limited said it has proposed a EUR 10bln investment for the Co.’s restructuring. Elsewhere in Italy, both Snam and Terna trade firmly in the green after yesterday’s heavy losses that buoyed the index.

Fixed income products initially softened alongside the higher open in European equities, with news that Apple are to launch Euro-denominated bonds and hawkish comments from ECB’s Nowotny who went against his ‘never say never’ attitude on Friday, also adding to the downside. Nonetheless, heading into the North American open Bunds have staged a turn around with some analysts suggesting that yesterday’s sell-off is somewhat overdone, with other analysts also suggesting short-covering head of the ECB on Thursday and thus prices have broken back above 151.00. However, this move was then further extended by the aforementioned EC forecasts, with German, France and Italy’s growth prospects all being cut.

In FX markets, AUD continues to recover from overnight losses, which stemmed from the Australian ABS revising their unemployment rate higher to 6.2% from 6.1%, with markets instead focusing on the RBA dropping their ‘AUD remains historically high’ phrase. Elsewhere, EUR/USD continues to remain magnetised by 5.9bln due to roll-off at 1.2500 for today’s NY cut, while GBP has slipped back below 1.6000 following the lacklustre UK construction PMI release (61.4 vs. Exp. 63.5 (Prev. 64.2)) which came in at a 5-month low. Furthermore, the USD-index has given back some of yesterday’s gains underpinning JPY and thus dragging USD/JPY back below 114.00.