Image Source:

Image Source:

London stocks opened lower on Friday as investors digested an unexpected rise in retail sales data, although both indexes were poised to break a two-week losing streak, buoyed by anticipated Bank of England rate (BoE) cuts and healthy corporate updates. The blue-chip index was down 0.6% heading into the close, after closing at its strongest level since late May in the previous session, while the domestically focused FTSE 250 index dropped 0.2% after hitting over a two-week high on Thursday. A 1.7% gain in the industrial metal miners sector kept losses at check as copper prices rose due to China’s stimulus measures. Luxury brand Burberry’s 3.6% gain boosted the personal goods sector to lead sectoral gains. British retail sales figures on Friday showed an unexpected 0.3% rise in September, while analysts had forecast a monthly fall of 0.3%. The sterling ticked 0.4% higher after the data. Consumer-focused stocks were the biggest drag on the benchmark, with heavyweight Unilever dropping 1.4%, while British American Tobacco lost 1.6%. The Dunhill and Lucky Strike maker was the top loser on the FTSE 100 index. The company has filed a plan in a Canadian court to potentially resolve and settle the tobacco litigation of its Canadian unit, but no details of the plan were disclosed. The company’s unit, Imperial Tobacco Canada (ITCAN), said the settlement would be funded by cash on hand and cash generated from the future sale of tobacco products in Canada. British American Tobacco’s shares have risen approximately 17% year-to-date.Evokeup, a British betting and gaming firm, saw its shares rise as much as 6.6% to 61.1 pence, making it the top gainer on the FTSE small-cap index. The company reported a 3% growth in third-quarter group revenue to 417 million pounds ($544.64 million) and reiterated its H2 outlook, expecting revenue growth of 5-9% and an adjusted core margin of about 21%. CEO Per Widerström stated that the online business is the clear growth engine for the group and that the turnaround of the business is working after EVOK posted its first quarter of revenue growth since March 2022. However, the stock is still down around 40% from its last close.In broker updates, Bunzl, a British business supplies distributor, experiences a 1.7% decline to 3,548p. Citigroup downgrades the stock to “neutral” from “buy” but maintains a price target of 3700p. Citigroup states there is less room for further catalysts to boost the share price. Bunzl is up approximately 12% year-to-date as of the last close. Citigroup finds it difficult to articulate further incremental, positive share price catalysts given the high expectations. The stock is rated “hold” on average, with a median price target of 3,500p according to LSEG.

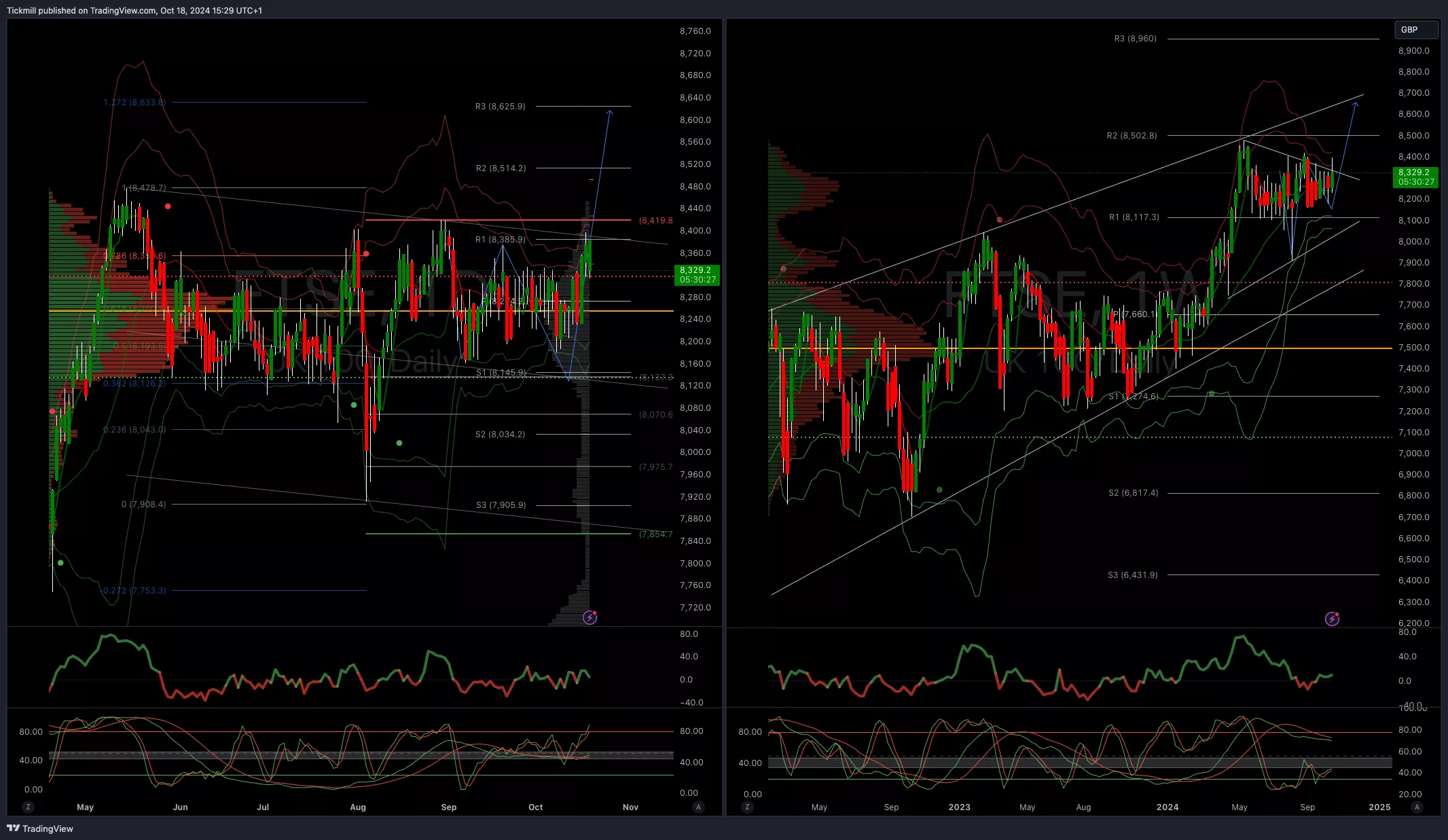

Technical & Trade ViewFTSE Bias: Bullish Above Bearish below 8225

(Click on image to enlarge) More By This Author:

More By This Author: