The UK’s FTSE 100 reached a three-week high on Monday as a weaker dollar boosted metal prices, offsetting a drop in Kingfisher’s shares after the home improvement retailer issued a profit warning. Despite chancellor Rachel Reeves’ continued controversy over tax increases, U.K. markets saw a modest increase. After rising 1.4% on Friday, the benchmark FTSE 100 was up 0.33%. Bank of England Deputy Governor Clare Lombardelli expressed greater concern about the risk of inflation rising higher rather than lower than the central bank’s forecast, arguing for only gradual reductions in interest rates. She noted that recent downbeat business surveys suggested inflation could cool, while strong wage growth posed a threat in the opposite direction. Additionally, British households’ disposable income fell in October, and rising inflation may dampen spending this Christmas, according to supermarket group Asda.Single Stock Stories:

Shares in Anglo American have risen by 2.5% to 2,417 pence, making it one of the top percentage gainers on the FTSE 100 index. The mining company Anglo American has agreed to sell its Australian steelmaking coal mines to Peabody Energy for up to $3.78 billion. The deal includes an upfront payment of $2.05 billion at completion, deferred cash consideration of $725 million, potential for up to $550 million in price-linked earnout, and contingent cash consideration of $450 million linked to the reopening of the Grosvenor mine. After the coal business, Anglo American is expected to spin out its Anglo American Platinum unit in South Africa by mid-2025. Anglo American’s shares have risen by around 22% so far this year.

Kingfisher, a European home improvement retailer, saw its stock price drop 10.3%, the lowest level since August 5, 2024. The company lowered the top end of its annual profit before tax outlook to 510-540 million pounds from 510-550 million pounds. Kingfisher reported a 1.1% decline in Q3 underlying sales and stated that October trading was impacted by uncertainty related to government budgets in the UK and France. The company expects the impact of higher employers’ National Insurance Contributions detailed in the UK’s budget to cost the group about 31 million pounds before any mitigations, and measures in the French budget would cost the company about 14 million pounds.

Shares in ITV, the British broadcaster behind popular shows like “I’m a Celebrity… Get Me Out of Here” and “Coronation Street”, surged 10% after Sky News reported that the company could be a potential takeover target for a team led by CVC Capital Partners.

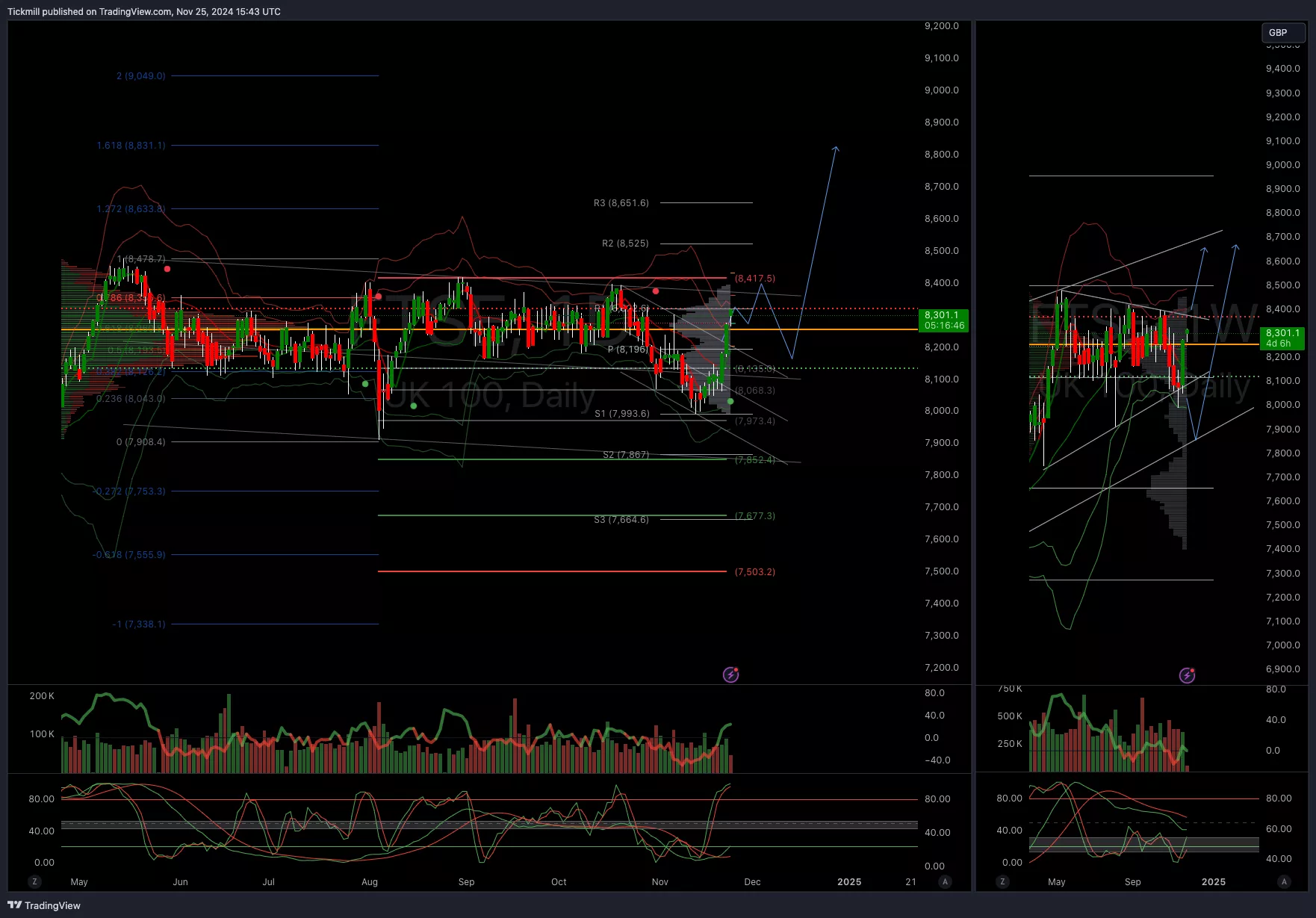

Technical & Trade ViewFTSE Bias: Bullish Above Bearish below 8225

(Click on image to enlarge) More By This Author:

More By This Author: