Image Source:

Image Source:

The FTSE 100 index initially increased on Thursday, supported by Diageo following a brokerage upgrade, while SThree negatively impacted the midcap index as it fell to its lowest point in over four years due to a profit warning. Heading into the close investors have booked profits ahead of tomorrow’s GDP update which has seen a reversal into a marginal decline on the day.Single Stock Stories:

Shares of British banknote manufacturer De La Rue declined by 2.3% to 107 pence. The company reported a first-half adjusted operating profit of £7.3 million ($9.32 million), which exceeded guidance for low single-digit profits, compared to £7.9 million last year. Revenues for the first half were £141.1 million, down from £161.5 million the previous year. The first-half Group revenue of £145 million represented a 10% year-on-year decline, with challenges stemming from a tougher comparison in H1 24 related to currency, along with some cash deliveries being delayed to H2, according to a note from Deutsche Bank. The company reaffirmed its guidance for FY25 Group adjusted operating profit in the mid to high £20 million range. Despite the recent drop, the stock remains up approximately 26.88% year-to-date.

Shares of Currys rise 8.1% to 85.1 pence, leading the FTSE mid-cap index. The company reports H1 adjusted profit before tax of £9 million, up from a £16 million loss last year, and maintains its annual profit growth forecast despite expected price hikes. H1 revenue increases 2% to £3.9 billion, with like-for-like sales also up 2%. CEO Alex Baldock expresses confidence in continued profit and cash flow growth. Currys stock is up 56.4% year-to-date.

SThree shares drop 35.3% to 233.5p, the lowest since May 2020, as the global recruiter warns of tough hiring conditions and expects FY25 pre-tax profit of about £25 million, significantly below analysts’ estimate of £66.6 million. Peers Hays and PageGroup also decline, with SThree’s stock down ~45% this year.

Broker Updates:

UK spirits maker Diageo Plc saw its shares rise by 3.2%, making it the top gainer on the FTSE 100 index, which was up 0.1%. This increase followed an upgrade from UBS, which changed its rating for the company from ‘sell’ to ‘buy’ and raised the price target from 2,300p to 2,920p. UBS highlighted positive indicators for Diageo’s U.S. business, noting that key brands, such as Don Julio and Crown Royal, are experiencing strong growth, outperforming a sluggish spirits market. Despite the gains in this session, the stock is still down 10.2% year-to-date.

Shares of Pennon Group rose 3% to 612p, making it a top gainer in the FTSE 250 index. Barclays upgraded the stock to “overweight” from “equal weight” and raised the price target to 800p from 690p, citing a significant discount to peers and high gearing levels. They believe a favorable final price determination by the regulator on Dec. 19 could benefit Pennon due to its leverage and potential capital requirement reductions. Currently, 4 of 13 brokerages rate the stock “buy” or higher, while 9 rate it “hold,” with a median price target of 682.50p. The stock is down about 21% year-to-date.

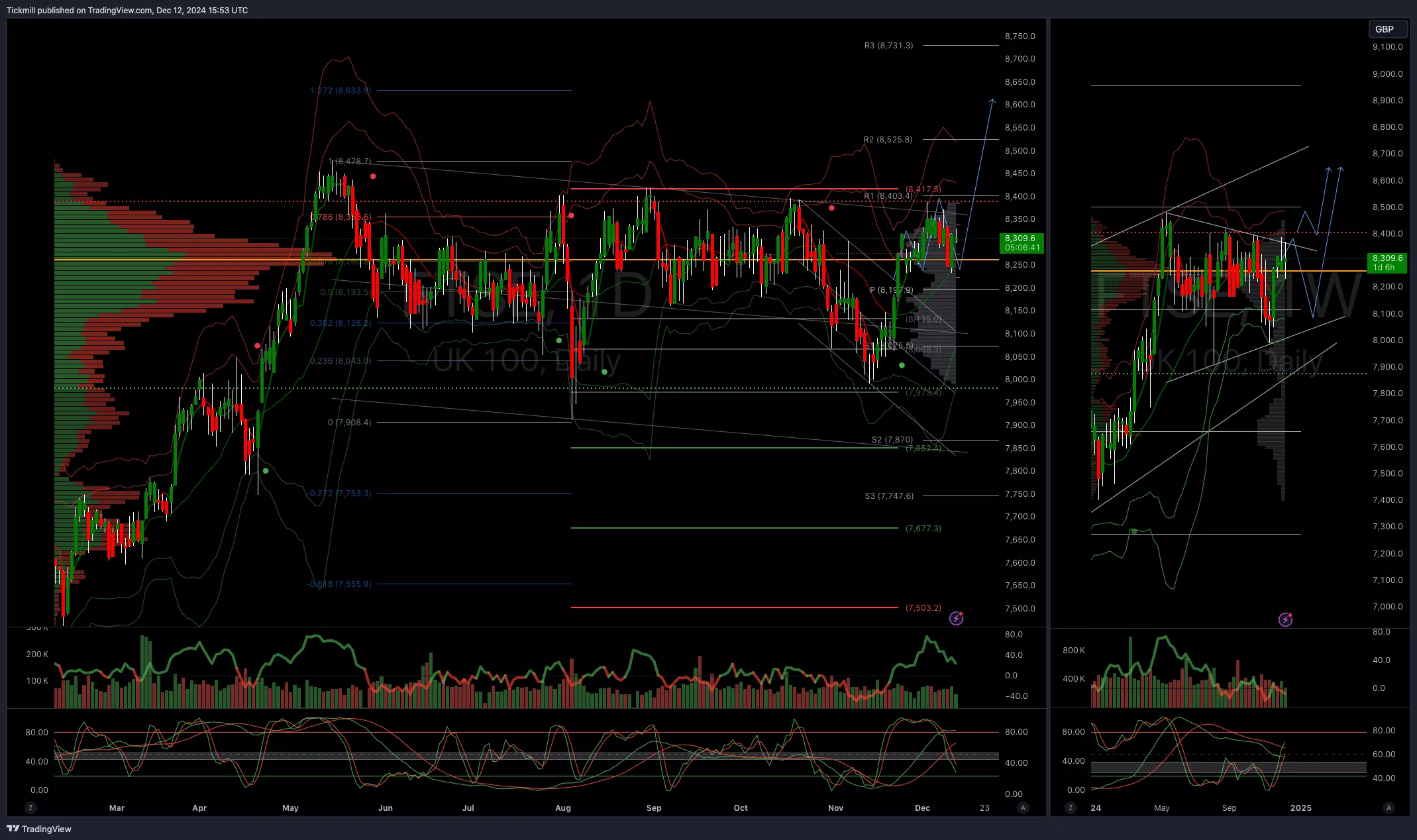

Technical & Trade ViewFTSE Bias: Bullish Above Bearish below 8225

(Click on image to enlarge) More By This Author:

More By This Author: