Image Source:

Image Source:

After experiencing their worst day since August in the previous session, UK shares increased on Monday. The modest advance came even as economic data did little to excite animal spirits with the UK’s business activity growth slowing in September, with the composite PMI index declining to 52.9 from 53.8 in the previous month, missing the forecast of 53.5. The services sector PMI fell to 52.8 from 53.7, also below the expected 53.5, while the manufacturing PMI remained unchanged at 52.5. Additionally, UK factory export orders declined at the fastest pace since December 2020. As markets head into the close, the FTSE blue chip index is positive by 0.67%. The FTSE100 experienced its worst performance in almost seven weeks on Friday, after the Bank of England kept interest rates unchanged on Thursday, even as the Federal Reserve cut benchmark rates by a substantial 50 basis points.In single stock stories, UBS initiates coverage with a “sell” recommendation, resulting in a more than one-year low for B&M in the United Kingdom. The shares of British discount retailer B&M have fallen by 3.8%, the lowest level in over one and a half years. The stock is the most significant decliner on the FTSE 100 index, with a 0.04% decline. UBS anticipates a “declining competitive advantage in FMCG (the primary traffic generator).” UBS asserts that Tesco and Sainsbury’s enhanced competitiveness poses a threat to B&M’s like-for-like (LFL) sales and foot traffic, as consumers consolidate their journeys and migrate away from discounters. In the second quarter, UBS anticipates that B&M’s LFL will continue to be poor. B&M’s stock price has declined by approximately 25% year-to-date. Dunelm in the UK benefits as UBS upgrades to “buy.” Dunelm is one of the top gainers on the FTSE mid-cap index, up 1.8% at 1,234p.UBS raises its price target to 1,410p from 1,111p and promotes “buy” over “neutral.” As the UK market recovers, UBS expects that the homeware business will benefit from its strong market position and profitable expansion. Beyond the average estimate of 4.8%, UBS projects DNLM’s revenue growth to reach 5.5% during FY24–26. On DNLM, 12 analysts have indicated a median price target of 1,185p, with the stock up 16.1%. YTDRightmove UK gains as Murdoch-backed REA makes another acquisition offer. Rising 3.8% to 700p, Rightmove shares lead the gains on London’s blue-chip index. Rupert Murdoch’s News Corp. owns a significant stake in the Australian real estate listing company REA Group, which has made a third acquisition offer for a British property web. The most recent proposal values RMV at £6.1 billion ($8.12 billion) in cash and stock. RMV rejected the first two proposals, claiming they undervalued the business. As of the most recent close, the stock has increased by around 17% this year.

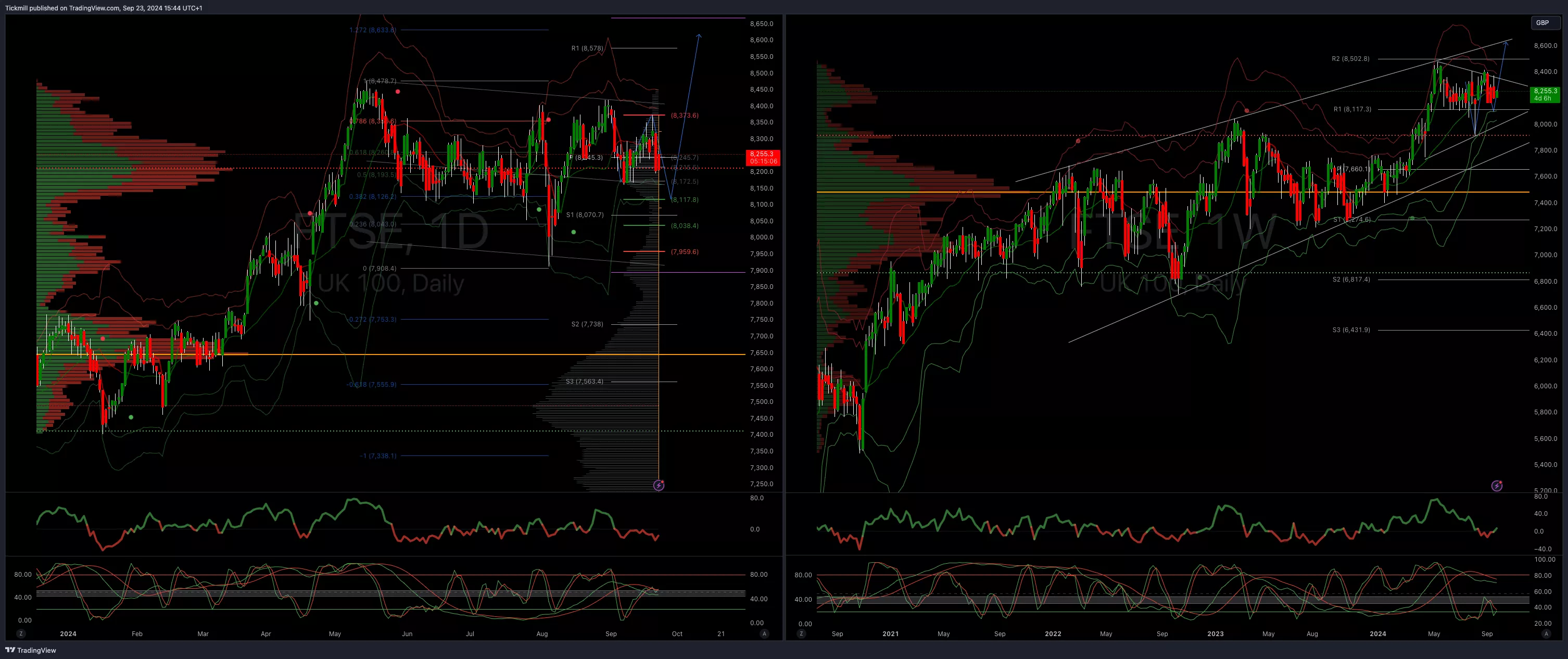

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

(Click on image to enlarge) More By This Author:US500 Weekly Action Areas & Price ObjectivesFTSE Fading From Two Week Highs As Pound WeighsFTSE Off Best Levels As BoE Stands Pat, Sterling Shines

More By This Author:US500 Weekly Action Areas & Price ObjectivesFTSE Fading From Two Week Highs As Pound WeighsFTSE Off Best Levels As BoE Stands Pat, Sterling Shines