The FOMC is now meeting for the first time with Janet Yellen as Chair. Goldman’s US team expects the FOMC to deliver an accommodative message…alongside a continued tapering of asset purchases. However, they note, their market views here are likely to shift little in response, as much of that dovishness is arguably already priced, particularly in US rates. SocGen notes that “qualitative guidance” will probably consist of two components: the FOMC’s forecast for the fed funds rate (aka “the dotsâ€) providing a baseline scenario, and a descriptive component signalling the elasticity of this rate path to the underlying economic outlook. SocGen also warns that this transition is worrisome for inflation in 2015. But BofA suggests this is not problem as The Fed will indicate the US economy “lift-off” in late-2015 will save us all.

Via Goldman Sachs,

Some accommodative changes expected from the FOMC later today

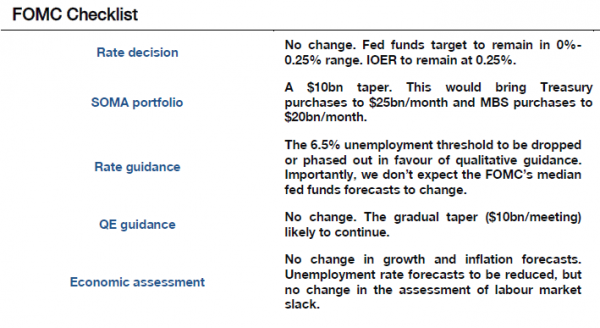

The FOMC is now meeting for the first time with Janet Yellen as Chair. In addition to the usual post-meeting statement release later today, there will also be the quarterly release of the Summary of Economic Projections and a press conference with Chair Yellen. The current backdrop presents several challenges for the Fed. The US growth data have slowed, perhaps because of weather (our own models suggest that about ½ of the 1pp decline in implied real GDP growth is weather-related), but expectations remain firm that growth will accelerate later this year. The unemployment rate has declined sharply and is only two-tenths of a percent away from the Fed’s stated 6.5% target. And the FOMC has already embarked on a tapering of asset purchases, currently at about $10bn/month.

Given this backdrop, and under the guidance of Chair Yellen, our US Economics team expects the FOMC to deliver an accommodative message. They will likely acknowledge weather effects, but only partly, in describing current economic conditions and they are likely to continue to taper asset purchase at the current pace. Alongside this, we expect three other shifts that, taken together, are marginally more accommodative.

First, the FOMC’s long-run unemployment and funds rate projections may both decline.

Second, we expect two participants to move their target dates for the first rate hike (the so-called “dotsâ€) further out.

Third, we expect the FOMC to move towards a more qualitative description of the labour market conditions needed to shift to a less accommodative policy stance.

This qualitative guidance could occur alongside the current 6.5% unemployment rate threshold or in place of it.

Despite these expected shifts from the Fed, our current assessment of where key macro-driven asset markets are likely to head over the medium term is not particularly captive to the outcome of today’s meeting. This is in part because some markets – rates in particular – have already reflected an accommodative Fed stance, leaving them relatively more exposed to the expected pick-up in US growth, and in part because other macro themes are likely to remain in focus, such as the ongoing adjustment process in EM assets and China-related weakness.