The active fund management industry is under siege. After years of underperformance, investors are losing patience with active managers and as the cost of beta drops, assets are flooding to passive managers. The falling cost of beta isn’t the only reason why the active management industry is suffering. Low-cost robo-advisers and smart beta are replicating the services of traditional asset managers at a fraction of the cost.

Also see:

- Why Passive Investing Increases Corporate Activism

- Joel Greenblatt: Passive Investing Good For Most People

- How Passive Investing Creates Concentrated Portfolios

- The Dirty Little Secret Of Passive Investing

According to research from Morgan Stanley published earlier this year, the market leading passive fund provider Vanguard’s fees are as low as 13 bps per annum, compared to the average dollar-weighted expense ratio of mutual funds, which stands at 100bps. Meanwhile, the median fee rate for Smart Beta funds has fallen by 25 bps since 2012. The standard account fee for a Vanguard Robo account is only 30 bps, 70 bps less than the average mutual fund fee.

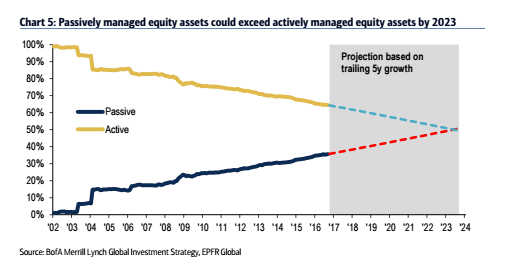

Most analysts expect the transition from active to passive management to accelerate going forward. According to research from Bank of America, published the beginning of this month, if the trend seen over the past few years continues for the next five years, passively managed equity assets could exceed actively managed equity assets by 2023 as a percentage of total industry assets under management.

Based on all of the above, it’s no surprise that short active asset managers is becoming a hot trade.

Franklin Resources: The Best Short In The Asset Management Space

Franklin Resources (BEN) has been pitched as the most compelling short in the asset management space at the MYST Advisors October 26 Bear’s Den Lunch.Â

Asset management industry trends are severely impacting Franklin’s growth and business model. According to the presenter who pitched Franklin as a short, the company has the highest average fees in the asset management space. Franklin’s average fee is 60 bps VS 45 bps to 55 bps for peers. These high fees are driving outflows, which are currently running at a rate of around 11% per annum. Franklin’s assets under management peaked at $921 billion in the fourth quarter of 2014 and have since declined to $732 billion.Â