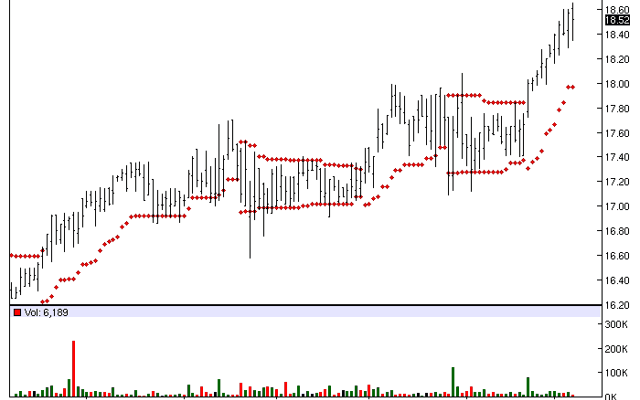

The Chart of the Day belongs to Fox Chase Bancorp (NASDAQ:FXCB). I found the savings bank stock by using Barchart to sort the Russell 3000 Index stocks first for the highest number of new highs in the last 20 trading session, then again for a technical buy signal of 80% or better, then I used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 11/20 the stock gained 2.89%.

Fox Chase Bancorp is the mid-tier stock holding company of Fox Chase Bank, a federally chartered savings bank. The Bank offers traditional banking services and products from its main office in Hatboro, Pennsylvania and other branch offices in Bucks, Montgomery, Chester, Delaware and Philadelphia Counties in Pennsylvania and Atlantic and Cape May Counties in New Jersey. The bank’s vision is to be the leading relationship-based business and consumer bank in the markets it chooses to serve by delivering financial products and services consistent with what the clients care about most. Serving a growing number of satisfied clients will drive earnings growth and profitability. Year-over-year earnings growth will enable the bank to choose to remain a viable, profitable, independent growth-oriented company. The bank’s success will be achieved through a professional, engaged, and satisfied workforce that has an ownership stake in the company.

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report.

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 5.27% in the last month

- Relative Strength Index 72.75%

- Barchart computes a technical support level at 18.18

- Recently traded at 18.52 with a 50 day moving average of 17.75