The latest CFTC data on the Commitments of Traders (CoT)Â shows some important moves in the positioning of speculators.

Australian dollar (FXA)

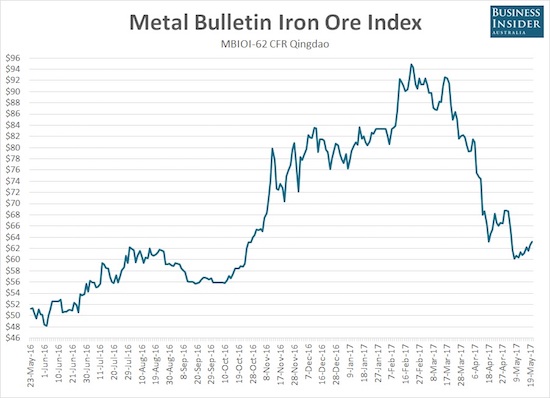

While the price of iron ore plunged, bullishness on the Australian dollar (FXA) remained surprisingly strong. I am almost equally surprised to see this bullishness now in full scale retreat as iron ore attempts a relief rally off a 7-month low. Over the last two weeks, the net long contracts held by speculators dropped to near zero.

The price of iron ore is trying to recover from a 7-month low and a 3+ month plunge.

Source:Â Business Insider

Speculators in the Australian dollar have cut net positioning to near zero. Speculators have not been bearish in over one year, so the current retreat is notable and significant.

Source:Â The latest CFTC data on the Commitments of Traders (CoT)

I am still bearish against the Australian dollar and expect a lower currency once the reality of “lower for longer†iron ore prices settles in. While I have a standing short in the form of long AUD/JPY, I have recently cycled in and out of long EUR/AUD given my bullishness on the euro.

EUR/AUD has shot up sharply since a 4-year low in March. Yet, I think there is still plenty of upside left – at least to 1.56.

Source:Â FreeStockCharts.com

Euro (FXE)

Speaking of the euro, the switch to bullish sentiment may be in its early stages. Speculators increased net longs from the previous week’s switch from bearish to bullish positioning. Given the weight of bearishness suffered by the euro since 2009 combined with a likely turn in economic prospects and monetary policy, I think a sustained switch is underway that could drive the euro to much higher levels over time. Against the U.S. dollar, the euro has effectively erased its post-election losses. I am still in a buy-the-dip and sell the rally mode on EUR/USD. Playing the current uptrend channel has happened to turn into a major winner.