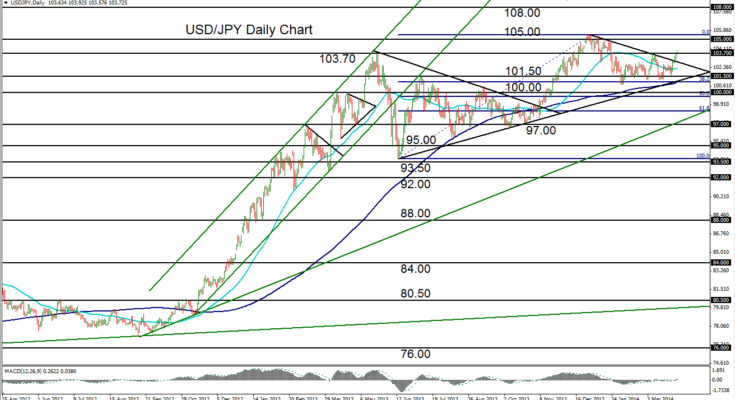

April 2, 2014 – USD/JPY (daily chart) has tentatively broken out above the prolonged trading range that has been in place since January. Within the past week, the currency pair has managed to advance above its 50-day moving average, a downtrend line extending back to December’s five-year high of 105.43 and, most recently, the last major high of 103.75 that was hit in early March. Having just cautiously risen above this 103.75 high before pulling back slightly, USD/JPY has made an attempt to break the consolidation that has prevailed for much of 2014 thus far.

Despite the recent consolidation, the currency pair is still trading within a substantial bullish trend that has been in place since late 2012. The tentative breach above this consolidation provides some needed support to USD/JPY bulls. If the pair is able to trade and maintain above 103.75, the path could be cleared for a re-test of the 105.00 area. Any subsequent move above the noted multi-year high of 105.43 would confirm a continuation of the long-standing bullish trend, and could potentially begin to target further upside around the 108.00 resistance level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.