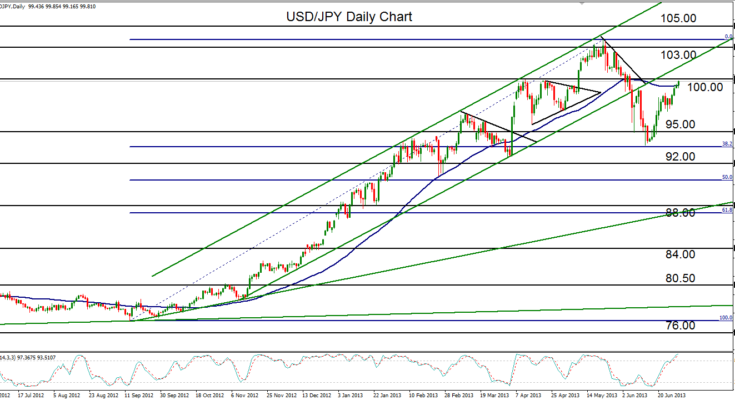

July 01, 2013 – USD/JPY (daily chart) has continued its sharp recovery of the past two weeks to approach major resistance around the key 100.00 figure on Monday. This partial recovery follows a substantial bearish correction that occurred from late May to mid-June, which brought price down from its multi-year high of 103.72 in May down to a 93.77 low in June. Price turned back up at the June low, which also coincided with the 38.2% Fibonacci retracement level of the entire bullish trend. While the recent bearish correction appeared deep, it was a rather shallow one within the context of the larger trend. Now bumping up against key 100.00 resistance once again, the strong uptrend continues to assert itself, placing the pair at a critical juncture. A significant breakout above 100.00 would confirm the bullish recovery, with upside price objectives around 103.00 and then a retest of the noted May 103.72 high. A major resistance target further to the upside is the 105.00 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.