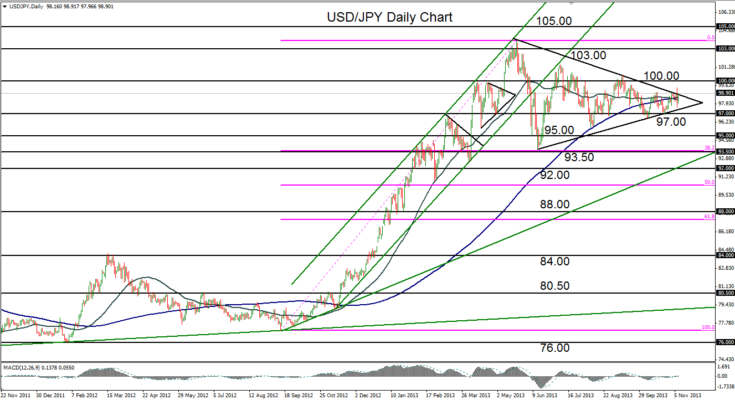

November 8, 2013 – USD/JPY (daily chart) has attempted to breakout above a large triangle consolidation pattern that has been in place for more than five months since the multi-year high of 103.72 was hit in May. The pair broke out tentatively yesterday, hitting a high of 99.40, before pulling back. The upper border of this triangle extends from the May 103.72 high and connects the September high at 100.60 to the highs of the past week. During the course of this narrowing consolidation, volatility progressively decreased and the 50-day/200-day moving averages converged and crossed slightly. This provided an indication that volatility was near its low extreme and there was the potential for a breakout of the triangle consolidation.

Yesterday’s tentative upside breakout could develop into a larger breach, especially if the pair goes on to breakout above the key 100.00 resistance level. If that is to be the case, the clear upside objectives are the 103.00 resistance level and then a re-test of the noted 103.72 multi-year high. Strong downside support continues to reside around the 97.00 level, which was last tested and respected just two weeks ago.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.