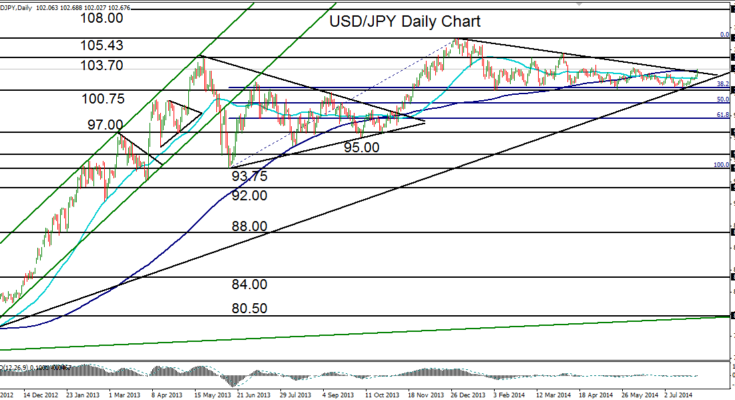

July 30, 2014 – USD/JPY (daily chart) has advanced sharply within its prolonged trading range to reach and tentatively breach its 200-day moving average after the release of better-than-expected U.S. GDP data on Wednesday. This rise extends a steady advance for the past two weeks from a low just above 101.00 in mid-July.

Since the beginning of the year, when the currency pair hit a five-year high of 105.43, USD/JPY has gradually drifted lower in an extended trading range with progressively diminishing volatility. During the course of the past seven months, this trading range has established the 100.75 level as the key support level to the downside, and has also formed a descending trend line to the upside that extends back to the noted 105.43 high.

While the 100.75 support level was respected with a rebound two weeks ago, both the descending trend line and the 200-day moving average have tentatively been broken to the upside as of Wednesday morning as a result of the dollar’s rise on GDP data.

If the currency pair can sustain this spike, the next major upside resistance objective resides around the 103.70 level. Any breakout above that level should target a re-test of the long-term high at 105.43. To the downside, major support on any pullback continues to reside around 101.00.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.