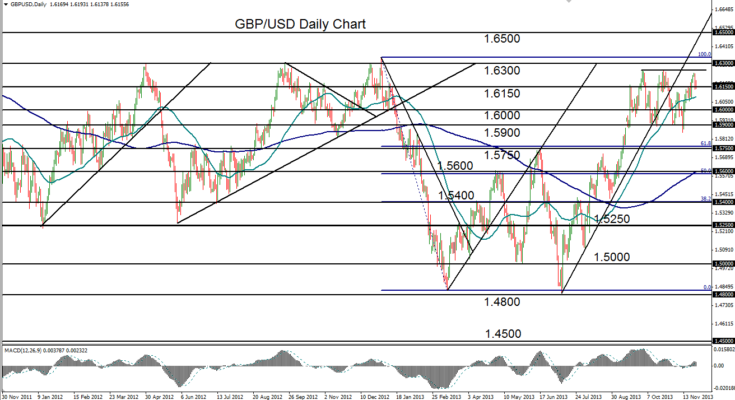

November 26, 2013 – GBP/USD (daily chart) has stalled after retreating once again from key resistance around the 1.6250-1.6260 price zone, reverting back into the trading range that has been firmly in place for the past two months. This trading range exists roughly between 1.6250 resistance to the upside and 1.5900-area support to the downside, and it is situated at the high end of a long and steep bullish trend extending back to July’s 1.4800-area low.

Monday’s price action marked the third time that the pair has turned down from the same resistance area, and highlights the strength and significance of that zone. Even on a breakout above that 1.6250-1.6260 resistance, the major 1.6300 resistance level resides immediately to the upside, providing another substantial barrier to a continuation of the uptrend. In the event that the breakout does occur, however, key upside objectives on a confirmed bullish continuation are at 1.6500 and 1.6750. Major downside support within the trading range currently continues to reside around 1.6000 and the noted 1.5900 range support.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.