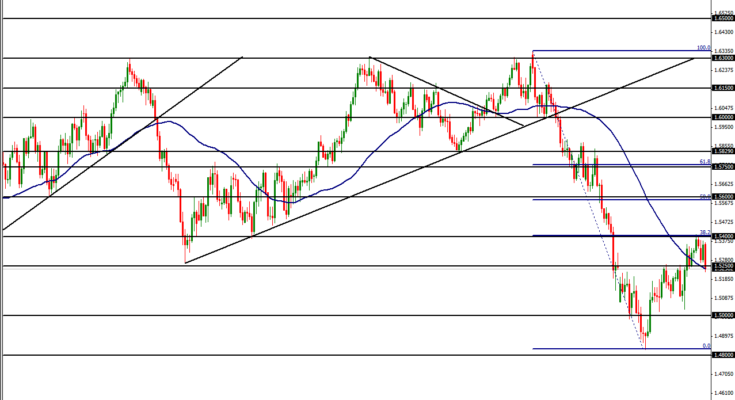

April 17, 2013 – GBP/USD (daily chart) declined significantly during early Wednesday trading to make a tentative downside breach of major support around the 1.5250 level. Currently, price is also around the vicinity of the 50-day moving average. This drop occurs after a pivotal turn to the downside that occurred late last week off a resistance confluence combining the key 1.5400 level and the 38.2% Fibonacci retracement of the steep plunge from the 1.6337 high in the beginning of the year down to the 1.4830 hammer candle low in mid-March.

A daily close below 1.5250 would provide further indication of a potential resumption of the strong bearish trend that has been in place since the start of the calendar year. In that event, the 38.2% upside correction that spanned from mid-March to mid-April would just be considered a simple and shallow pullback within a major downtrend. Further downside objectives on a potential bearish resumption reside in the near-term around the 1.5000 and then 1.4800 levels.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.