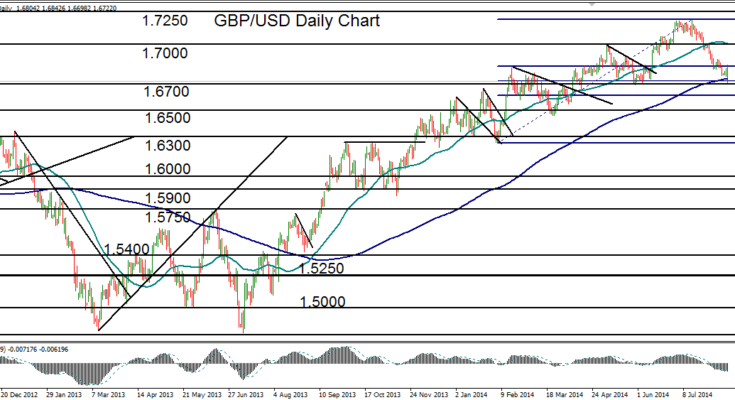

August 13, 2014 – GBP/USD (daily chart) dropped sharply in early trading on Wednesday to hit a low just slightly below a major support level at 1.6700. This decline establishes a new two-month low for the currency pair. It has also placed GBP/USD below its 200-day moving average for the first time in over a year.

From its multi-year high of 1.7190 in mid-July, the pair has made a steep, one-directional drop of almost 3% in the past month. In the process, it has broken down below several major support levels, including the 1.7000 level, the 50-day moving average, and now, the 200-day moving average.

Having begun this current drop as a simple pullback within a strong bullish trend that extends back for more than a year to the July 2013 low, GBP/USD has now extended its decline to seriously threaten this longstanding uptrend.

If the currency pair can sustain its current downside momentum with a breakdown below the noted key support level at 1.6700, the long-term bullish trend will have been critically interrupted or potentially broken. In this event, the next major downside targets reside around 1.6500 and then the key 1.6300 support level.

To the upside, any bounce from around the current support should meet intermediate resistance around the 1.6850 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.