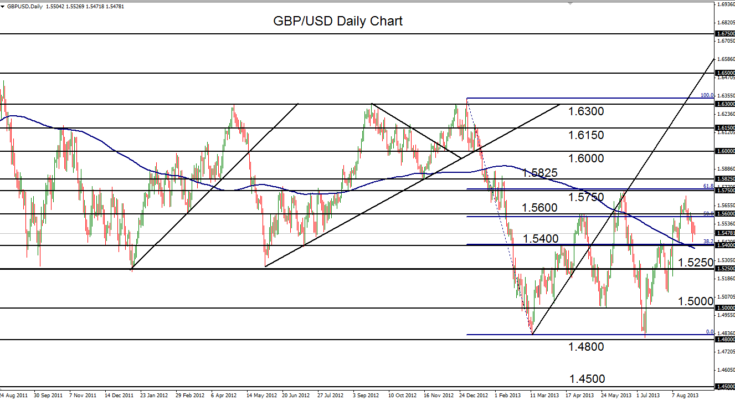

August 30, 2013 – GBP/USD (daily chart) has continued to fall back after having hit a two-month high at 1.5716 last week – just shy of the major 1.5750 resistance level – and then turning back to the downside. The resulting bearish retreat of the past week and a half has brought the currency pair back down once again to approach major support around the 1.5400 area, one of the most pivotal support/resistance levels for GBP/USD in recent weeks and months. The downward-sloping 200-day moving average also currently resides just under 1.5400 support. With significant downside momentum currently prevailing for the pair, and renewed dollar strength tentatively in play virtually across the board, a key bearish indication would be a breakdown below 1.5400 support. This event would confirm a further bearish bias for the pair, with initial downside support objectives residing around 1.5250 and then the key 1.5000 psychological level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.