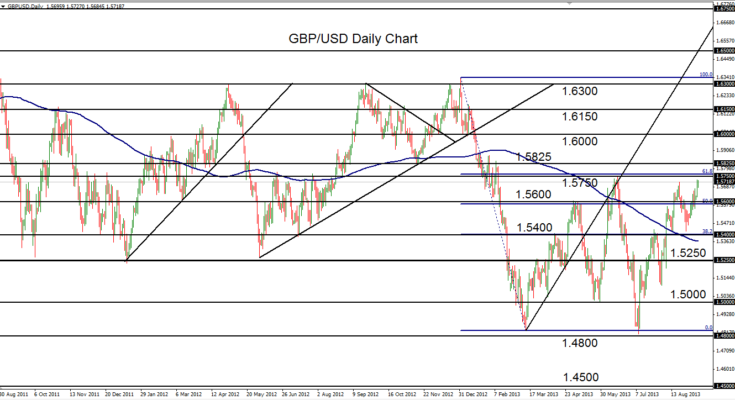

September 10, 2013 – GBP/USD (daily chart) has once again advanced to key resistance around the major 1.5750 level, establishing a 12-week high in the process. This price action occurs within the context of a strong, short-term bullish trend that extends back to the early-July double-bottom low just above 1.4800 support. The last time this currency pair approached the 1.5750 resistance level was in late August, when it reached a high of 1.5716 before pulling back and then rebounding off the 1.5400-area support. That rebound has now resulted in the current bullish leg, which has just slightly surpassed the noted late-August 1.5716 high. With the major 1.5750 resistance level now immediately to the upside, GBP/USD is at a critical price juncture. Further bullish momentum that breaches 1.5750 should target immediate further resistance around 1.5825 and then the major 1.6000 figure. Tentative downside support within the context of the current bullish trend resides around the 1.5600 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.