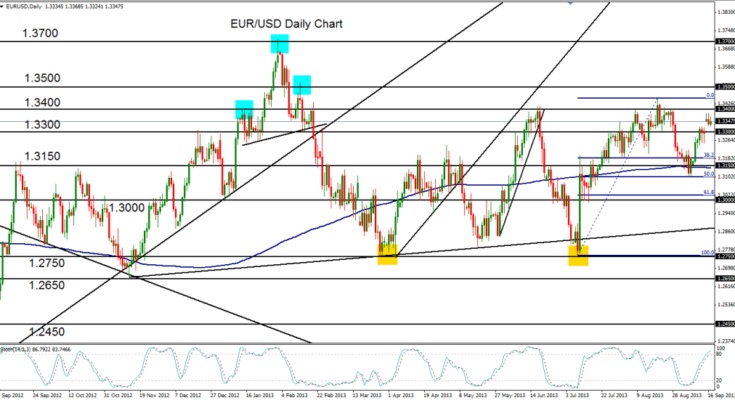

September 17, 2013 – EUR/USD (daily chart) has stalled after a bullish leg originating from the 1.3100-area low in early September advanced the currency pair to break out above the 1.3300 resistance level and most recently to approach key resistance around the 1.3400 level. After reaching a two-and-a-half week high at 1.3385 yesterday, the pair has moved within a low volatility consolidation. If this consolidation represents a bull flag-type technical pattern, the pair could be preparing for another break to the upside, although the 1.3400 level presents formidable resistance.

The two primary levels to watch are the 1.3400 resistance to the upside and the 1.3300 support to the downside. A strong breach above 1.3400 would confirm a continuation of the latest bullish leg, with upside targets at 1.3500 and further up around the major 1.3700 resistance level (February’s high). A breach below 1.3300 would continue the range-trading environment that has been in place for the past six months, with an initial downside objective around the 1.3000 psychological level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.