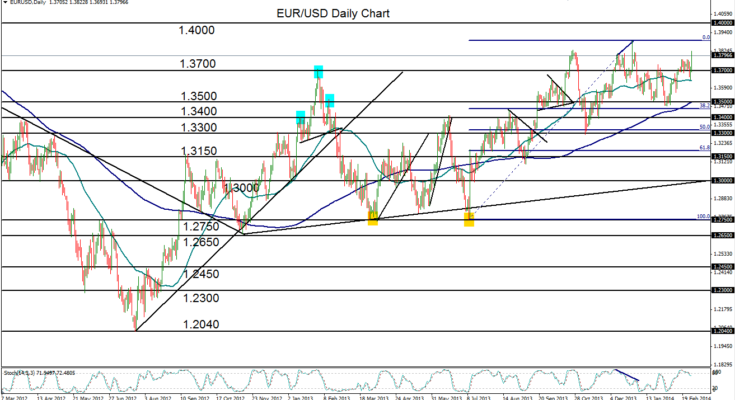

February 28, 2014 – EUR/USD (daily chart) spiked early in Friday’s trading session to hit a high of 1.3822 before consolidating its gains. In doing so, the currency pair has closely approached the two-year high of 1.3892 that was established in late December. The sharp advance also constitutes a rebound from its 50-day moving average after the pair dipped to a shallow low of 1.3642 on Thursday. The current rally occurs in the context of a general bullish trend that extends back to July’s low near 1.2750, and even further back to 2012’s 1.2040 low.

Price action on EUR/USD could be setting itself up for one of two scenarios. In the event that the currency pair continues its upside momentum next week with a breakout above the noted 1.3892 December high, the bullish bias and uptrend continuation will have been confirmed, with further upside resistance targets at 1.4000 and then potentially, 1.4250.

If price action fails to re-test December’s high, and turns sharply back to the downside, the pair could be setting itself up for a potential head-and-shoulders topping pattern – with the left shoulder in late October, the head in late December, and the right shoulder currently in the process of forming. In the event of this potentially bearish scenario, initial downside price targets reside around 1.3500 and 1.3300.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.