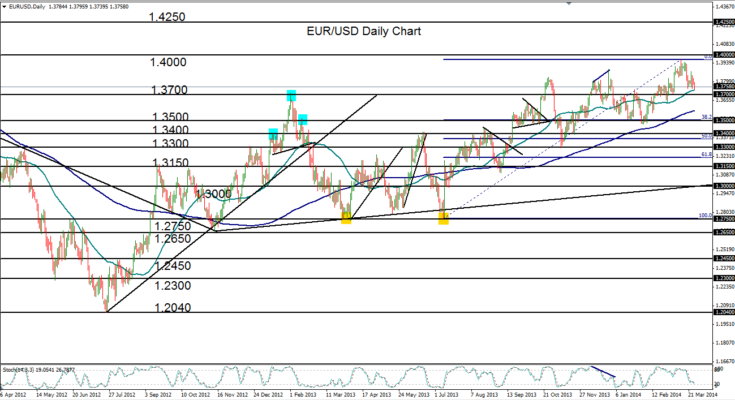

March 27, 2014 – EUR/USD (daily chart) has declined to its 50-day moving average and continues to languish significantly below its long-term high of 1.3965 that was established just two weeks ago. After that high was reached, just short of its 1.4000 psychological target, the currency pair has pulled back and consolidated just above both the noted 50-day average and the 1.3700 support level. This currently places EUR/USD still well within the boundaries of the bullish trend that has been in place since July’s double-bottom low near 1.2750.

The 50-day moving average has provided support for the generally rising pair since mid-February and appears currently to be doing the same. If this support is breached with a further breakdown below the noted 1.3700 support area, major downside support resides around the 200-day moving average and then the key 1.3500 level. 1.3500 is not only an important support/resistance and psychological level, but is also around the 38% Fibonacci retracement of the current uptrend from July’s 1.2750-area low up to the 1.3965 high two weeks ago. The major upside resistance targets on any bullish trend resumption continue to reside around the 1.4000 and then 1.4250 levels.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.