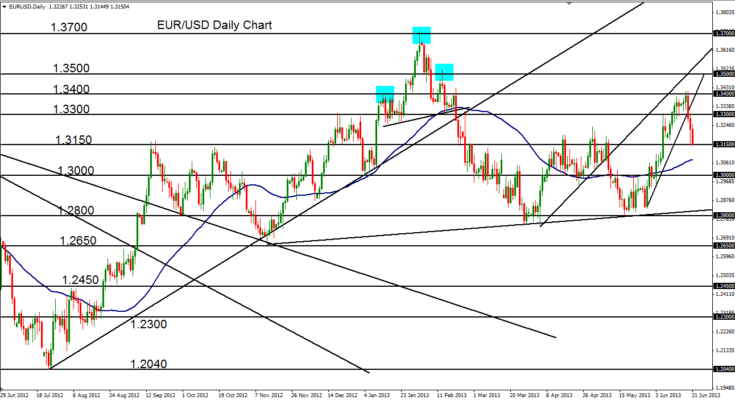

June 21, 2013 – EUR/USD (daily chart) has extended its three-day decline by dropping to major support around the 1.3150 price region. This drop occurs on marked U.S. dollar strength this week that saw the pair end a steep bullish run and establish an intermediate top just above 1.3400-area resistance mid-week before turning sharply to the downside. Momentum on this sharp downturn continues to be strongly bearish after three substantial down days, and is not showing any signs of relenting. A continuation of downside momentum moving forward into next week could see EUR/USD target its major support/resistance pivot level at the 1.3000 figure, a breakdown below which could move towards key 1.2800 support and then a potential resumption of the bearish trend that has been in place since early February.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.