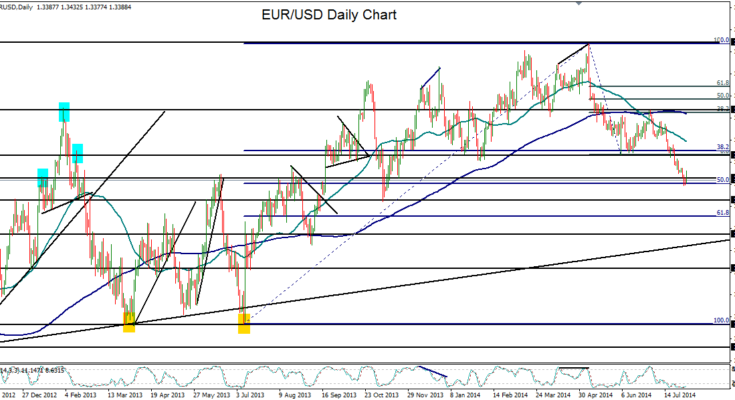

August 1, 2014 – EUR/USD (daily chart) has continued to be weighed down in the midst of a sharp decline and new bearish trend of the past few months. Since the beginning of July, exactly a month ago, the currency pair has made an almost uninterrupted freefall from 1.3700-area resistance, extending the broader decline from May’s 1.3993 multi-year high.

The breakdown below 1.3500 within the past two weeks provided a pivotal indicator of EUR/USD’s continued bearish momentum. This week, the pair hit a depth of 1.3365, establishing a new 8-month low. This low also happens to be around the 50% Fibonacci retracement level of the previous bullish trend from the July 2013 low around 1.2750 up to the noted May 1.3993 multi-year high.

Despite a bounce in early trading on Friday, EUR/USD continues to maintain a strong bearish bias. The 50-day moving average crossed sharply below the 200-day average in late June and continues to slope sharply downward. With major upside resistance residing at the 1.3500 level, the currency pair could soon be poised to decline towards its next major downside target around the 1.3300 support level, last hit in November of 2013.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.