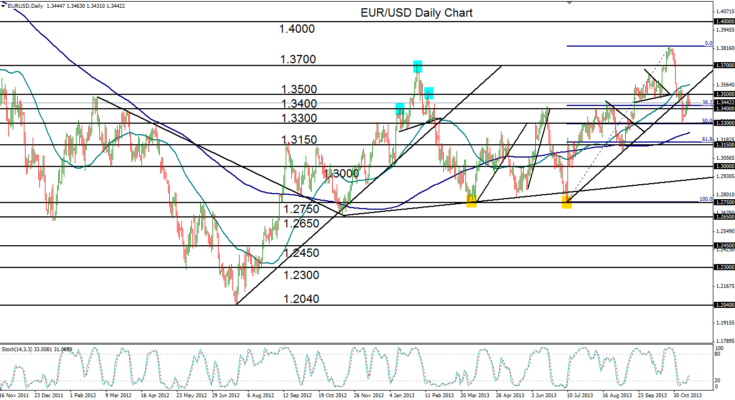

November 15, 2013 – EUR/USD (daily chart) has consolidated after declining sharply from its long-term high and then rebounding from the 1.3300 support level, which was also the 50% Fibonacci retracement of the bullish trend spanning from early July to late October. This rebound hit a high earlier in the week just under a confluence of the key 1.3500 resistance level and the underside of the bullish trend line before pulling back to its current consolidation. The sharp decline that occurred within the past three weeks broke down below the trend line before turning back up at the noted 50% level.

The key levels to watch for potential opportunities reside around the two mentioned levels of 1.3300 support and 1.3500 resistance. A breakdown below 1.3300 would extend the short-term trend reversal with near-term price objectives around 1.3150 and then the major 1.3000 psychological level. A break above 1.3500 would signal a potential trend recovery with the major intermediate price target at 1.3700.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.