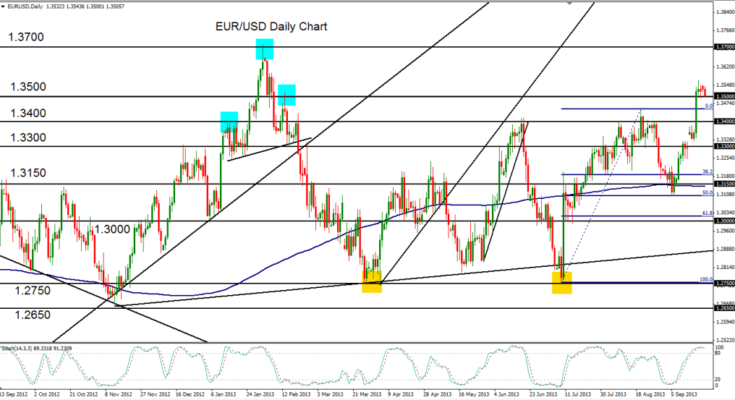

September 23, 2013 – EUR/USD (daily chart) has pulled back slightly in a tight consolidation pattern right around the key 1.3500 level after having made a dramatic break to the upside last week that hit a 7-month high at 1.3567. That breakout, which rose swiftly above the last major high of 1.3450 (established on August 20th) occurred mid-week last week around Wednesday’s Fed announcement. Price action for the remainder of last week subsequently showed little to no follow-through on that substantial move, and the pair has now formed a small, flag-like consolidation pattern just above major support/resistance at the breached 1.3500 level.

This key 1.3500 area is currently serving as tentative support for the pair. A breakout above the noted 1.3567 top, which is the high of the consolidation pattern, would confirm a continuation of the bullish leg that has been in place since the early September lows near 1.3100. In the event of a breakout above that consolidation high, the next major upside objective resides around 1.3700 resistance, which is the high established in early February. Any further pullback below 1.3500 has strong downside support at the 1.3400 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.

Â