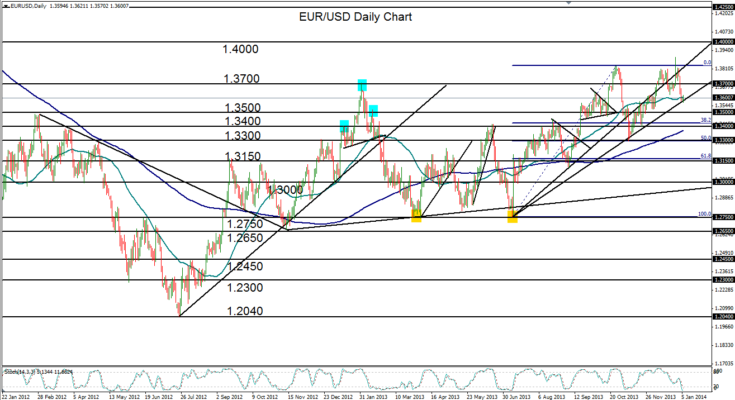

January 6, 2013 – EUR/USD (daily chart) has begun 2014 with a defensive pullback to a key uptrend line extending back to the July 1.2750-area double bottom low. In the process, the pair has also broken down below the key 1.3700 level, descended slightly below the 50-day moving average, and established a new one-month low. This occurs after a two-year high at 1.3892 was hit shortly before the New Year, extending the bullish run that had been in place since July.

The current deep pullback from that high has tentatively stalled and turned up slightly at the noted trend line. Having thus far maintained support, EUR/USD is still within the bounds of a bullish trend. A re-break above resistance at 1.3700 would provide indication of a recovery of the current pullback, potentially placing the pair on track to target higher resistance objectives once again around 1.4000 and 1.4250. A breakdown below the trend line could signal a return to lower levels, with key support at 1.3300.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.