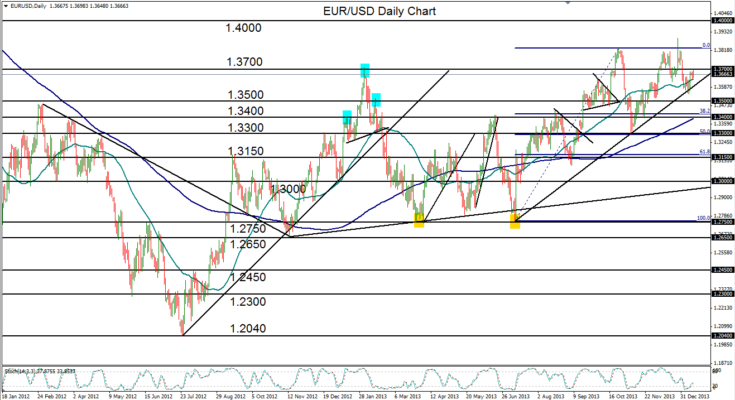

January 14, 2014 – EUR/USD (daily chart) has attempted to recover after a sharp price pullback brought the currency pair down to a low of 1.3547 late last week, right around a key uptrend line extending back to the July 1.2750-area double-bottom low. On declining to that uptrend support line, the pair quickly turned back up in its current attempt to recover the bullish trend that has been in place for the past six months. This pullback and tentative rebound occur after the pair spiked to hit a two-year high of 1.3892 near the end of 2013.

Currently, EUR/USD is near the 1.3700 resistance level and has risen slightly above its 50-day moving average once again. Still well above its 200-day moving average and within the confines of a bullish trend, EUR/USD could seek further upside to extend the entrenched uptrend. The key upside targets on an uptrend resumption reside around the 1.4000 and then 1.4250 resistance levels. To the downside, on any further pullback that breaks down below the noted uptrend line, major support continues to reside around the 1.3400 and 1.3300 levels.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.