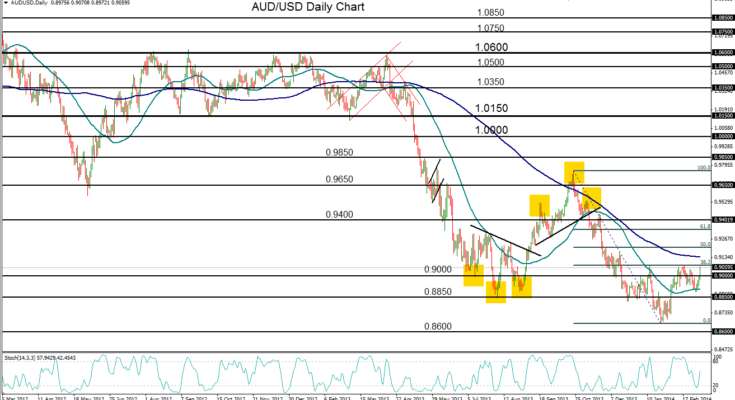

March 6, 2014 – AUD/USD (daily chart) has risen for a third time to key resistance around the 0.9080 level and has, in the process, formed a potential inverted head-and-shoulders pattern. The 0.9080 level represents major resistance, as it has halted the currency pair’s advance on two recent occasions – both in mid-January and mid-February. This level is also the 38% Fibonacci retracement of the last major bearish run – from October’s intermediate high at 0.9757 down to late January’s three-and-a-half-year low of 0.8659.

The inverted head-and-shoulders pattern that has tentatively formed – with its left shoulder at mid-December’s low, head at late January’s noted long-term low, and right shoulder at early March’s low – also has its neckline at the noted 0.9080 resistance level.  A potential reversal or interruption of the entrenched bearish trend could be in the making if there is a strong breakout and follow through above this level. Incidentally, if valid, this would be the third head-and-shoulders reversal pattern since June of 2013.

In the event of a breakout above the neckline resistance at 0.9080, the key upside target would reside initially around the 0.9400 level. This would be contingent on a breach above the 200-day moving average. To the downside, if the pair fails at or near the current resistance, downside support once again resides around the 0.8850 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.