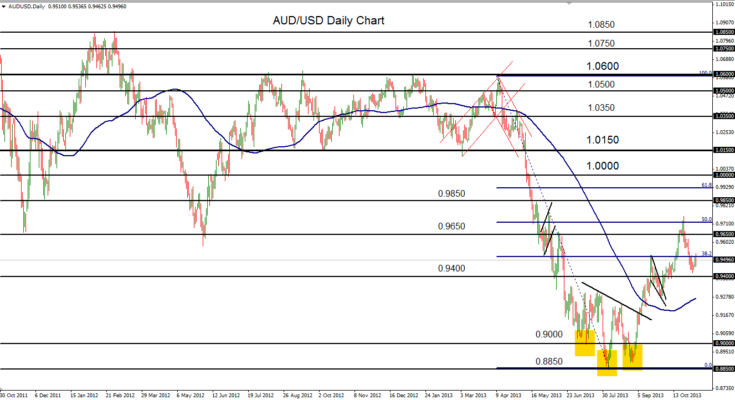

November 5, 2013 – AUD/USD (daily chart) has rebounded modestly off its low near 0.9400 support after having dropped precipitously from its near-term high two weeks ago at 0.9756 (which was around the 50% Fibonacci retracement of the steep April-August plunge). The pair had been rising in a partial recovery after having made a potential trend reversal to the upside in July, August, and September with an inverted head-and-shoulders pattern. The neckline of this pattern was broken to the upside in early September, and price subsequently reached up to an intermediate high of 0.9527 before pulling back in a steep falling wedge pattern.

The pair then broke out above that pattern to resurface above the 0.9400 level, with an upside target at 0.9650. It then broke out above 0.9650 on 18 October to reach a high at 0.9756 on 23 October (also the noted 50% Fibonacci level), missing its 0.9850 price objective for the time being, to pull back sharply down to a level just above 0.9400 once again. A further breakdown below 0.9400 would erase a good portion of the gains made since August, with strong further support down at the 0.9300 level. Any subsequent breakout above the noted 0.9756 high off the current rebound should once again target its 0.9850 price objective.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.