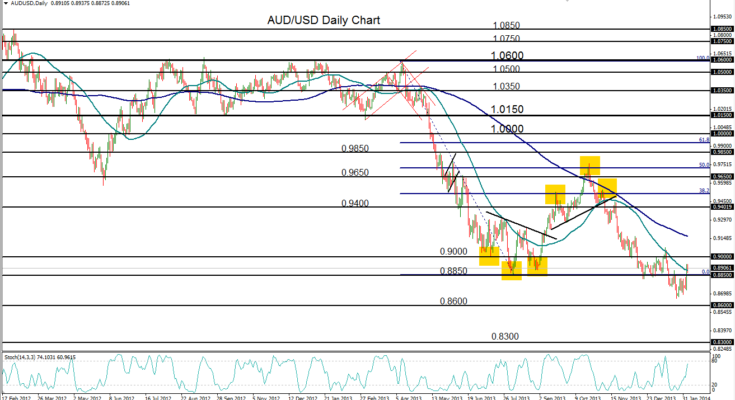

February 5, 2014 – AUD/USD (daily chart) has rallied to the upside to revisit its 50-day moving average in a modest upside pullback within an exceptionally strong bearish trend. This rally hit a high of 0.8940 on Tuesday before making a tentative consolidation as of Wednesday. The bearish trend that has been in place for the past nine months since the April 2013 high near 1.0600 established a three-and-a-half year low at 0.8660 in late January before the current upside pullback.  The prior pullback up to the 50-day moving average occurred in mid-January and hit a high around 0.9075 before plunging once again to continue the downtrend.

Currently, the rally is still within the confines of being a modest pullback within a strong bearish trend. This should continue to be the case even if the currency pair continues to move up towards the nearby 0.9000 resistance or even the noted prior high at 0.9075. A turn back down at or before these resistance levels are reached would provide some indication of a potential resumption of the entrenched downtrend. In that event, the previous downside targets of 0.8600 and 0.8300 would continue to be the prevailing price objectives.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.