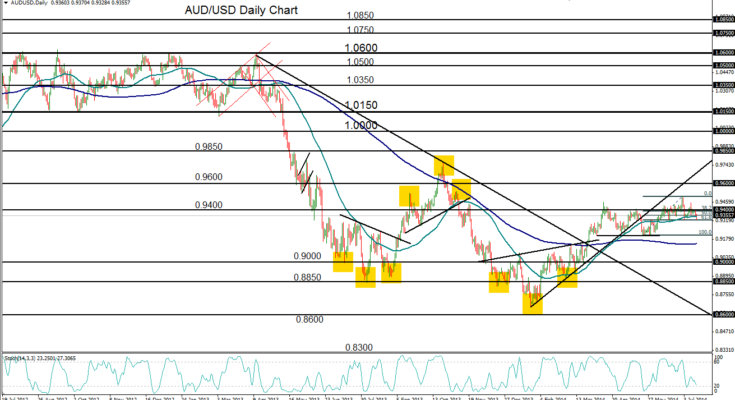

July 16, 2014 – AUD/USD (daily chart) has drifted lower in the past two weeks after hitting a 2014 high just above 0.9500 in the beginning of July. That high was the culmination of a one-month rise from the key 0.9200-area support level. This price action occurs within the context of a generally bullish trend that has been in place for most of 2014 thus far, since the late January multi-year low of 0.8659. This year’s bullish trend has recovered, year-to-date, only a relatively minor portion of the losses seen in 2013.

Currently trading around its 50-day moving average, the currency pair has entered into a consolidation phase with what currently appears to be a continued bullish bias. The 50-day moving average is well above the 200-day moving average, as has been the case since a rarely-seen upward cross occurred in April.

AUD/USD is currently trading just above short-term support around 0.9320. Any further pullback below this support level should meet major support around the noted 0.9200 area. To the upside, the key level to watch continues to reside around the noted 0.9500 level, this year’s peak. If the currency pair is able to retake this high, it should open the way towards its longstanding upside price target at 0.9600.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.