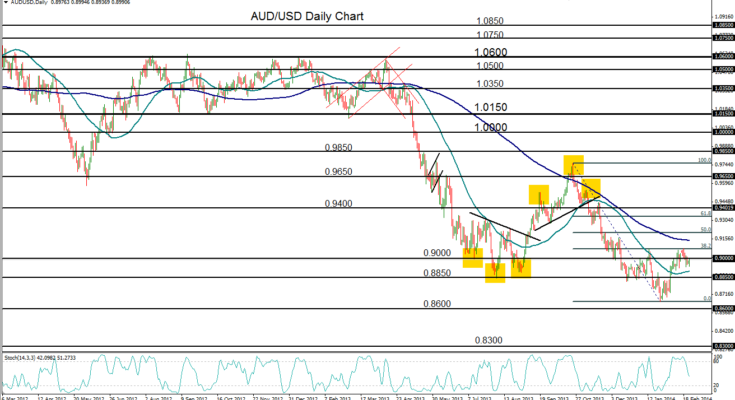

February 24, 2014 – AUD/USD (daily chart) for the past two weeks has been unable to make a significant upside breach of key resistance around the 0.9075 level, which was first established as a key high in mid-January. There was a close approach of that resistance level two weeks ago, followed by a slight breach of it last week, before the currency pair failed and retreated to the downside. AUD/USD’s attempt to emerge from late January’s three-and-a-half-year low of 0.8659 comes within a strong bearish trend, currently still intact, which extends back to the April 2013 high near 1.0600. Two opposing scenarios could likely occur for AUD/USD that should provide further directional guidance for the pair.

First, the noted 0.9075-area resistance represents a clear 38% Fibonacci retracement of the last major downtrend – from October’s 0.9757 high down to January’s noted 0.8659 long-term low.  Continued failure to breach this 0.9075-area resistance could signify a move towards continuation of the entrenched bearish trend, with further downside support targets around 0.8600 and then 0.8300. The second scenario shows a potential inverse head-and-shoulders pattern (left shoulder at mid-December’s low, head at late January’s long-term low, and right shoulder yet to be determined), which could portend a potentially disruptive bullish run with upside resistance targets around 0.9150 and then 0.9300.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.