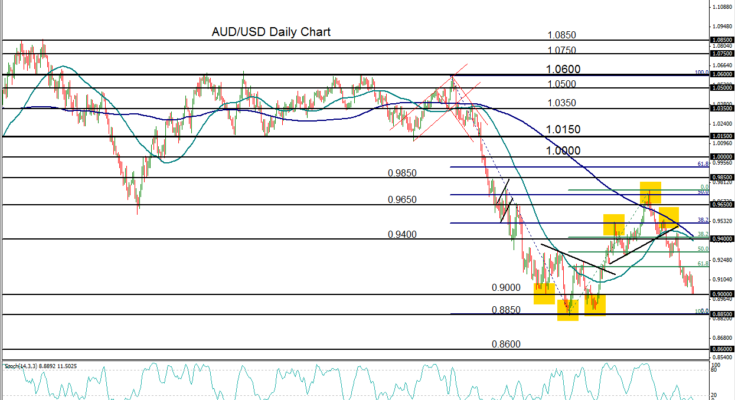

December 5, 2013 – AUD/USD (daily chart) has extended its six-week decline to hit key support around the 0.9000 psychological level. In the process, the currency pair established a three-month low yesterday. The current drop occurs after the pair formed a head-and-shoulders reversal pattern with its late-October high at 0.9757. The substantial bullish correction that was halted by this head-and-shoulders pattern represented a 50% Fibonacci retracement of the long and steep plummet from April to August. Shortly after breaking down below the neckline of this reversal pattern in early November, there was a brief pullback to the upside before the pair swiftly began its current slide.

With the downside target of the head-and-shoulders pattern having already been fulfilled around the 0.9050 level, the directional outlook for AUD/USD continues to look bearish. Currently, the clear downside objective after having dropped to the 0.9000 psychological support level now resides around the 0.8850-area multi-year low, which was hit in early August. Any subsequent breakdown below this level would clearly confirm a continuation of the overall bearish trend, with a further downside target around 0.8600. Key upside resistance currently resides around the 0.9200 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.