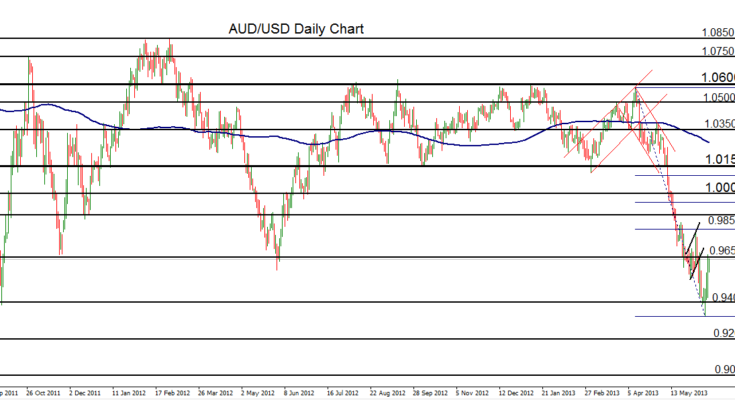

June 14, 2013 – AUD/USD (daily chart) has made a significant bullish correction within the span of the past week to bump up against the 0.9650 resistance area. The recent downtrend, which has effectively been in place since the April high near 1.0600, has been strong and steep with very little in the way of substantial upside corrections. The current advance could be an exception. Momentum above the 0.9650 area could potentially lead the way to a partial recovery back up towards parity (1.0000). Perhaps more likely, however, the current bullishness should exhaust itself well below parity and turn towards a resumption of the entrenched downtrend. In this event, downside support objectives include a re-test of this week’s 0.9325 low, and then further down towards the 0.9200 and 0.9000 support areas.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.