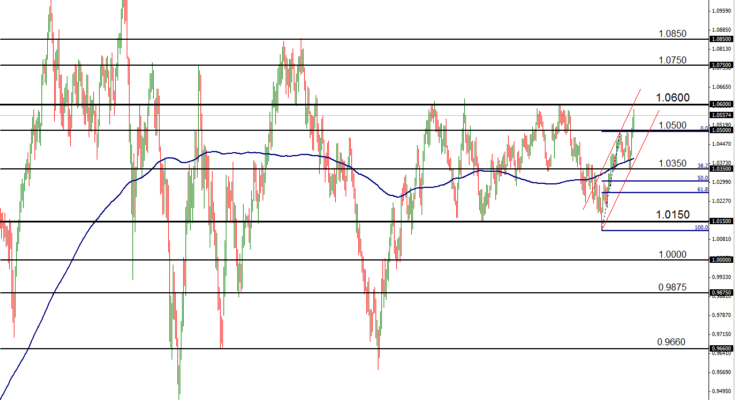

AUD/USD (daily chart) as of April 11, 2013 has reached up towards the top of a clear 9-month trading range, around the key 1.0600 resistance level. Having reached a high of 1.0581 today in early trading, price subsequently pulled back after approaching the long-standing range’s upper border by less than 20 points. The trading range extends back to July 2012, bordered to the downside by 1.0150 support and to the upside by the noted 1.0600 resistance. The most recent bullish leg of this trading range saw price rebound off of 1.0150 support in early March and rise steadily in an intra-range uptrend, making a 38.2% Fibonacci retracement just last week before rising rapidly this week towards its 1.0600 objective.

Whether the 1.0600 range resistance is broken significantly to the upside remains to be seen. In that event, a further upside resistance objective resides around the 1.0750 level. If 1.0600 is respected with a turn back to the downside, keeping the trading range intact, a breakdown of the current intra-range uptrend could prompt an eventual move back down to the 1.0150-area range support.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.