The global political concern known as “Brexit†is making shockwaves through the investment community this week.This may ultimately be the most important event of the summer for the stock, bond, commodity, and currency markets.While the final outcome is far from certain, it goes without saying that savvy, long-term investors will look at the pronounced volatility as an opportunity rather than a calamity.

The immediate aftermath of the Brexit vote is to simply propagate the existing trends in gold, Treasury bonds, and defensive sectors such as utility stocks.These areas of the market have been the beneficiaries of fresh capital and surging prices all year long.Furthermore, it has compounded weakness in banking and financial stocks, which have struggled in the face of falling interest rates and structural headwinds.

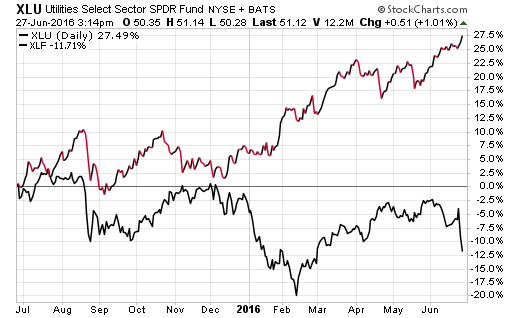

The widening gap between the defensive safe havens and the embattled financial sector may be signaling the development of a contrarian investment opportunity. The chart below compares the 1-year returns of the Utility Select Sector SPDR (XLU) versus the Financial Select Sector SPDR (XLF).

As you can see, XLF has traded below the flat-line for the majority of the year and continues to be one of the leaders on the downside in the midst of this latest crisis. Investors who focus on momentum would be loath to own a sector of the market showing such feeble price action. However, for those seeking a potential turnaround opportunity, it is an intriguing spot to watch.  Â

XLF is the largest exchange-traded fund dedicated to the financial sector with $15.9 billion in total assets. This ETF tracks 94 large-cap banking, real estate, insurance, and diversified investment companies in the S&P 500 Index. Top holdings include Berkshire Hathaway Inc (BRK-B), JP Morgan Chase (JPM), and Wells Fargo & Co (WFC).Â

On a year-to-date basis, XLF is down -9.01% and is the worst performing major sector in the S&P 500 Index. It is also moving up the charts for outflows as well. According to ETF.com, this fund has lost $1.92 billion since the beginning of the year and is in the top 10 ETFs for total redemptions.Â