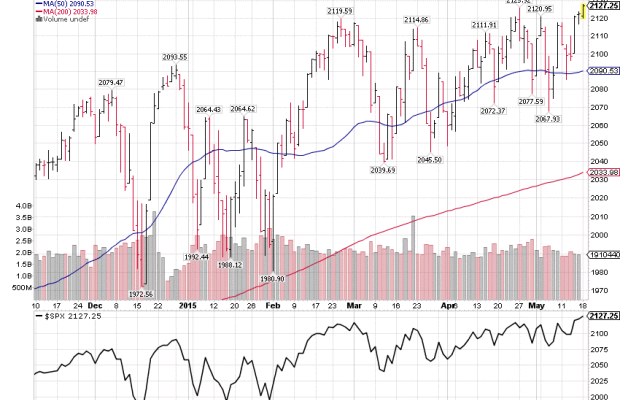

The US equity markets open the week on a positive note as both the Dow and S+P 500 market indices have made a new all time high. There have been numerous failed attempts to break out above this trading range over the last six months as US stocks hover around the break even level for year to date.

Â

One of the reasons for bullishness has been the strong internal readings from the cumulative advance – decline line of NYSE stocks listings. While the market indices remained range bound in making very little upside progress, the AD line has been steadily advancing in a strong uptrend, seemingly suggesting there is strong participation remaining in this macro up trend.

Â

However it is interesting to note that none of the nine main sectors of the S+P 500 are trading at all time highs along with the benchmark average.

Â

While most of the sectors are still within 2% of their six month highs, it is interesting to note that not one has made a new recent high as of yet. So there appears to be cases to be made on both sides. Earning seasons is winding down and recent econ data remains slow at best. For now it appears that Euro QE and subsequent international market rallies may be the rising tide that lifts all boats. The macro trends remain intact and with continued low interest rates and relatively low recessions risks, it appears the uptrend will remain in place.