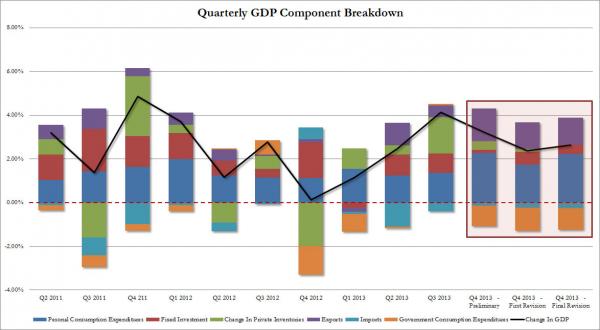

And so the various estimates of Q4 GDP have made an almost full circle: starting at 3.22% in the first forecast, plunging to 2.38% in the second, and finally settling at 2.63%, a miss from the expected 2.7%. This is down from 4.1% recorded in Q3 which however as everyone knows by now was purely due to a unprecedented, record inventory build up.

In terms of components, Personal Consumption was the silver lining in this latest economic miss, rising at a 3.3% pace higher than the expected 2.7%. This was driven by greater than expected spending on health and financial services. Yes – higher health insUrance costs are somehow a boost to GDP. How this offsets spending on other end goods and services with a finite and declining disposable income stream remains to be seen.

In terms of the actual contribution, Personal Consumption was 2.22%, above 1.73% in the prior revision, offsetting yet another decline in the contribution from Capex, i.e. Fixed Investment, which dropped from +0.58% to +0.43%. By now, however, even Larry Fink has figured out that as long as the Fed is around, there can be no true CapEx growth. Which means it is all about boosting Personal Consumption through the “Russell 200,000” wealth effect channel.

The full breakdown of quarterly GDP is shown below.

But don’t worry: those hoping Q1 will be better, don’t hold your breath. This is what’s coming. You know – “snow in the winter” and all that.

Â