Strap in for a wild ride! Â

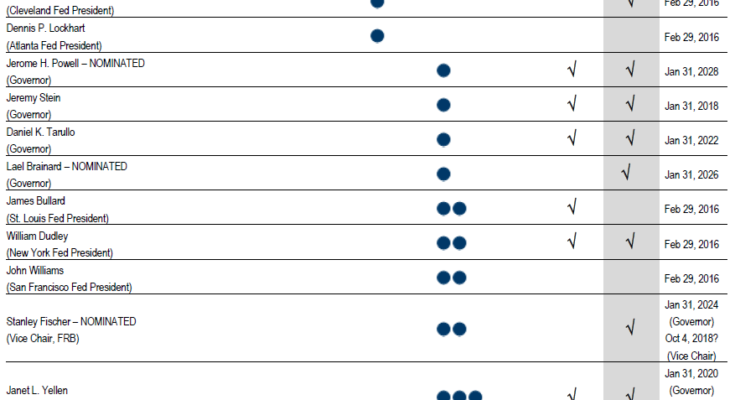

We’ve got the Fed’s Stein (9am) and R Fisher (1:45) today, Lockhart (4pm) and Plosser (7) tomorrow, Bullard (2am) and a Fed Capital Analysis Report on Wednesday(4pm), Pianalto (8:30 am) and Evans (9:30 pm) Thursday and Esther George gives the hawks the last word on Friday (1:15 pm).

So that’s dove, hawk, neutral, hawk, dove, neutral, dove, hawk for the week and, if that doesn’t confuse you enough, we’re also going to get 5 housing reports, Chicago, Richmond and Kansas City Indexes, two types of Consumer Confidence Reports, Income and Consumption data, Durable Goods and yet another reading of Q4 GDP.  If we survive all that – it’s time for Q1 earnings next week! Â

China is still melting down, Russia is still expanding its borders, Turkey shot down a Syrian warplane, that missing plane is still missing, Venice voted to leave Italy and Spanish protesters are “sick of Democracy” – so you can go right ahead and buy equities at near-record highs but I much prefer to watch and wait at the moment, thank you! Â

Stein already put out comments at midnight suggesting that monetary policy should be less accommodative when bond markets are overheated even if it raises the risk of higher unemployment.  I’m not sure if that is what he’ll say today but he did say:

“All else being equal, monetary policy should be less accommodative — by which I mean that it should be willing to tolerate a larger forecast shortfall of the path of the unemployment rate from its full-employment level — when estimates of risk premiums in the bond market are abnormally low.”

“There is a cost to be weighed alongside the benefit of an accommodative policy, insofar as it affects the degree of risk around the employment leg of the Federal Reserve’s mandate.â€