Four new stocks make our Safest Dividend Yields Model Portfolio this month, which was made available to members on September 20, 2018.

Recap from August’s Picks

The best performing large-cap stock was up 3%. Overall, four out of the 20 Safest Dividend Yields stocks outperformed the S&P in August.

This Model Portfolio leverages our Robo-Analyst technology[1], which scales our forensic accounting expertise (featured in Barron’s) across thousands of stocks.[2]

This Model Portfolio only includes stocks that earn an Attractive or Very Attractive rating, have positive free cash flow and economic earnings, and offer a dividend yield greater than 3%. Companies with strong free cash flow provide higher quality and safer dividend yields because we know they have the cash to support the dividend. We think this portfolio provides a uniquely well-screened group of stocks that can help clients outperform.

Featured Stock for September: Principal Financial Group (PFG: $60/share)

Principal Financial Group (PFG) is the featured stock in September’s Safest Dividend Yields Model Portfolio. PFG was also featured as a Long Idea in February 2018.

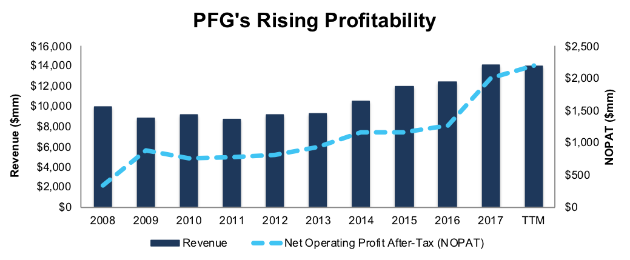

Since 2008, PFG has grown after-tax profit (NOPAT) by 20% compounded annually, to $2.0 billion in 2017. The company’s NOPAT increased to $2.2 billion over the trailing twelve months (TTM). NOPAT margins have increased from 4% in 2008 to 15% TTM while return on invested capital (ROIC) improved from 3% to 11% over the same time.

Figure 1: PFG Revenue & NOPAT Since 2008

Â

Sources: New Constructs, LLC and company filings

Free Cash Flow Easily Covers Dividend Payments

Over the past five years, PFG has increased its annual dividend from $0.98/share to $1.87/share, or 18% compounded annually. TTM dividend payments have totaled $2.05/share. This dividend payment has been supported by PFG’s free cash flow. From 2013-2017, PFG generated a cumulative $4.4 billion (26% of market cap) in FCF while paying $2.1 billion in dividends. Over the TTM period, PFG has generated $721 million in FCF and paid $573 million in dividends.