Had it not been for Friday’s dip, the market would have actually logged its third weekly gain in a row last week.  Problem is, Friday happened.  Indeed, Friday’s action may have underscored a much bigger problem for the bulls – a problem that could have been easily discarded with just a little progress.  Now that the problem’s been exposed though, it may become a huge psychological hurdle.Â

We’ll take a closer look at that potential pitfall in a moment. Â First, let’s dissect last week’s key economic numbers.Â

Economic Calendar

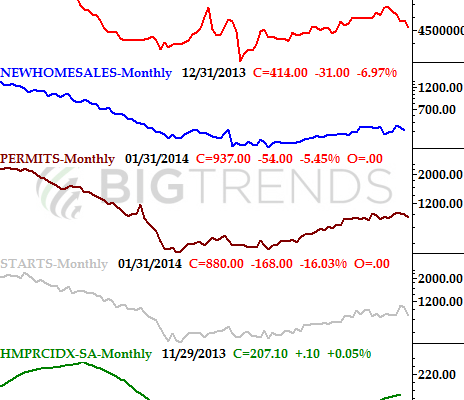

Last week’s economic data was overloaded with real estate and construction numbers.  And, though it wouldn’t be accurate to categorize those overall results as “bad”, they certainly weren’t good…. the recent weakness on the housing front continued to develop.  It’s pretty clear now that housing and homebuilding aren’t easy money, even if part of the snag last month wad weather-related.

Specifically, building permits fell from a pace of 991,000 to 937,000 in January, and December’s housing starts of 1.048 million fell to a pace of 937,000 last month. Â As for existing home sales, they fell from 4.87 million in December to 4.62 million in January.Â

We don’t yet have December’s home price data yet, but as you’ll see on the calendar below, the information is due on Tuesday (January’s housing price information won’t be available until late March). Still, assuming the modest slump in January’s activity isn’t a fluke, there’s likely to be some pressure on the price front too.Â

Real Estate & Construction Trends Chart

Â

The only other big data we got last week was inflation numbers from last month. Â Producer prices as well as consumer prices were up a tad in January, but just a tad. Â As of right now, the annualized consumer inflation rate is 1.58%, and the producer price inflation rate stands at 1.2%. Â While it’s good that prices aren’t soaring for anyone, it’s a little alarming that sellers don’t have at least a little more pricing power. Â Still, prices are relatively stable, and sustainable at current levels.Â