The housing market is much slower moving than equities since stocks have high liquidity. While it seems like a bad thing when stocks are falling and it’s in all the headlines, liquidity is a positive. Not being able to find a buyer for your real estate will cost you either time or money, meaning you can wait for someone to pay your price or lower the asking price to make a deal.

Rising interest rates are a negative catalyst the housing market didn’t need. Even though the labor market has been strong and real wage growth has been solid recently, housing has recently started to struggle because it outperformed wages for too long. Rising rates are a sign the economy is returning to normal growth, but they can also be the reason behind a decrease in the elevated housing prices, which are in some local markets outright bubbles.

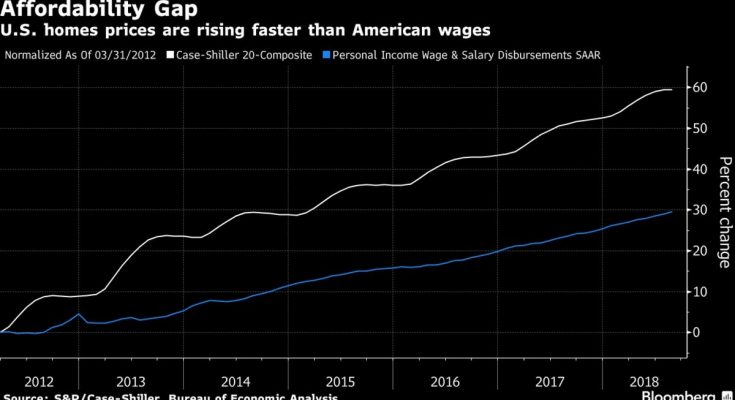

As you can see from the chart below, the affordability gap has risen in the past 6 years.Â

Source:Â chartÂ

The 20 city Case Shiller composite index is up about 60% since March 31st 2012 which is about double the growth in personal income wage and salary disbursements. Some areas can sustain high prices because their city has faster wage growth or encourages outsiders to invest. In the long run, wages and population growth are the main aspects that sustain home prices.

Changes in interest rates can have a massive impact on monthly mortgage payments, and thereby the affordability of a house. The chart below breaks down the changes in affordability caused by the spike in interest rates from 4% to 5%.Â

Source:Â Bloomberg

San Jose, which has the highest mortgages because it is extremely expensive, saw 39% of houses fall out of the market for would-be buyers.Â

Real Estate Is About Location

The current weakness in housing is a combination of a lack of affordability and rising rates. The other hot markets in this expansion, which are Seattle and Denver, saw 17% and 9% of houses drop out of the affordability range. New York hasn’t had a hot housing market since its Case Shiller index hasn’t reached the 2006 bubble peak, but even it lost 10% of its houses. As the chart below shows, real New York housing prices have fallen in 2018. Real price growth has been below the 20 year average since 2016.