Once again, a great deal of confusion surrounds the European Central Bank’s current policy objectives as well as the nearterm action expectations. Let’s try to tackle the subject in a Q&A format.

Q: Â Since the policy change announcement back in June, what has the ECB accomplished?

A: Â In addition to lowering short-term rates, the ECB has launched the TLTRO program (4-year cheap loans to banks) and began its third covered bond buying program (these bonds are issued by banks and secured with loans).

Q: Â What has been the impact of the ECB’s interest rate reductions?

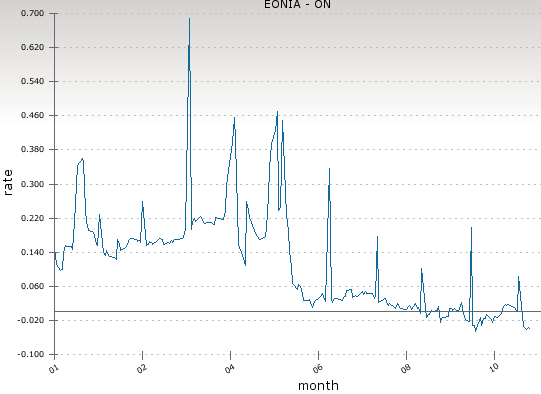

A:  The overnight benchmark rate has been set to near zero and the excess reserve rate has been moved to negative 20bp to incentivize banks to deploy capital. This has resulted in negative overnight interbank rate – banks pay each other to park their cash (which is still cheaper than parking cash with the ECB).

Â

|

| Overnight interbank rate in the euro area (source:Â emmi) |

Furthermore, the euro’s decline that resulted from negative rates and a possibility of further easing is expected to provide support for the export-dependent euro area nations.

Â

Q: Â Has the rate action resulted in more lending in the euro area?

A: Â The immediate reaction of the area’s banks to the negative deposit rate was to buy massive amounts of sovereign debt, including periphery bonds. This has resulted in unprecedented declines in government bond yields across the yield curve.

Â

There is evidence however that credit conditions in the euro area are beginning to ease. Growth in broad money supply measures for example has improved markedly.

Â

|

| M3 YoY (source: ECB) |

However, it remains unclear whether monetary policy had much to do with this development. Instead the banking system deleveraging cycle, which started a few years ago, is gradually ebbing. Moreover, the conclusion of the ECB’s stress tests should help banks deploy more of their balance sheets in the private sector without the uncertainty surrounding the stress testing process hanging over them.

Q: Â How much in TLTRO loans has been taken up by the banking system thus far?

A:  About €90bn – see story. This is well below some of the more conservative projections.

Q: Â How much ABS (asset backed securities, such as credit card and auto loan receivables) and covered bonds has been purchased since the announcement of the program?

A: Â The ECB has acquired a small amount of covered bonds but no ABS thus far – see schedule.

Q: Â What has been the impact on the Eurosystem’s (ECB’s) balance sheet?

A: Â The impact has actually been a net decline, as banks continue to repay their MRO and the original LTRO loans.

Â