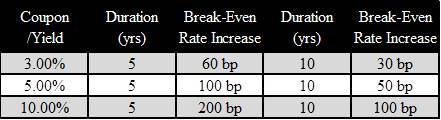

In the current low interest rate environment across the Treasury curve and investment grade credit space, low coupon rates provide less protection against market value loss resulting from rising interest rates. When interest rates were higher, fixed income investors enjoyed the benefit of earning higher recurring income to offset any market value declines. As the bond markets have converged to near historic lows in yield levels, this dynamic has changed dramatically. To contrast the degree of income protection relative to market value changes, the table below summarizes the break-even rate increases for different hypothetical situations.

Â

The table shows the extent to which interest rates can rise over a one-year period before the resulting market value loss completely offsets the interest earned during that period. For example, a 5–year duration portfolio yielding 3% will suffer enough mark-to-market loss given a 60 basis point rise in rates to break-even on a total return basis over a one-year holding period. For a 10-year duration portfolio yielding 3%, the break-even rate increase is only 30 basis points. In a higher yield environment, the table shows that similar duration portfolios can withstand larger moves in rates before the portfolio starts losing money.

Current spread levels in the credit markets do not provide much additional buffer. Since credit spreads on a wide range of product sectors are approaching multi-year lows, the additional yield pick-up for going down in credit does not provide a significant amount of additional protection. Additionally, any use of leverage will further reduce the break-even levels since financing costs will detract from current income.

Regardless of whether investors believe interest rates are likely to rise significantly in the near term, the current low yield and narrow credit spread environment has made rising rate protection strategies more compelling with the potential to provide greater protection for fixed income portfolios.