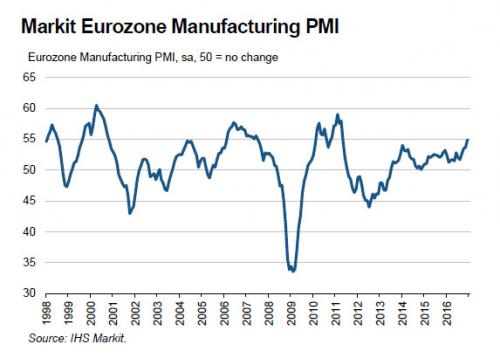

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

“Euro-zone manufacturers are entering 2017 on a strong footing, having ended 2016 with a surge in production,†said Chris Williamson, chief business economist at IHS Markit. “Policy makers will be doubly-pleased to see the manufacturing sector’s improved outlook being accompanied by rising price pressures.â€

Some details from today’s PMI report:

Perhaps as a result of another rogue algo operating in thin markets, today it was the Euro’s turn to tumble, and instead of rejoicing at this manufacturing strength, the European currency took no comfort from the figures, and suddenly dipped by 40 pips, sliding 0.3% back below $1.05 after climbing to as high as $1.07 during a flash surge in low trading volumes in Asia on Friday.

The weakness in the currency, however, was ignored by stocks and in early trading the euro zone’s blue-chip Euro STOXX 50 index as well as the broader STOXX 600 rose by 0.5% to its highest since December 2015 after the purchasing managers’ index (PMI) for factories in the currency bloc came in at 54.9 – well above the 50 mark that separates growth from contraction.

Italy’s stock index hit its highest level since January last year, outperforming other major European stock indexes, with a rally in its banks and a strong manufacturing report improving sentiment. Italy’s FTSE MIB index was up 1.3% by 1000 GMT after rising to its highest since January 15 of 2016. Germany’s DAX was up 0.9% at its highest in nearly 17 months, while France’s CAC was up 0.3 percent after hitting a 13-month peak earlier in the day.