European stocks are down led by tech, chemicals, alongside EM stocks which retreated from near a one-year high and oil fell for the first time in a week after hawkish comments from Federal Reserve officials revived bets on U.S. interest rate rises this year, and pushed the dollar higher from 7 week lows ahead of today’s Fed Minutes. S&P 500 futures were little changed following yesterday’s drop from record highs.

The Stoxx Europe 600 Index fell for a fourth day, while MSCI’s gauge of developing-nation shares also declined, having halted an eight-day winning streak on Tuesday.

Â

Crude pulled back from a five-week high as the Bloomberg Dollar Spot Index rebounded from near a three-month low after two regional Fed chiefs indicated interest rates could be increased at least once this year. South Korea’s won tumbled by the most since Britain voted to leave the European Union and gold declined. After sliding as low as 99.50 yesterday, a rebound in the USDJPY to 101 overnight pushed the Nikkei higher by 0.9%, closing at 16,746.

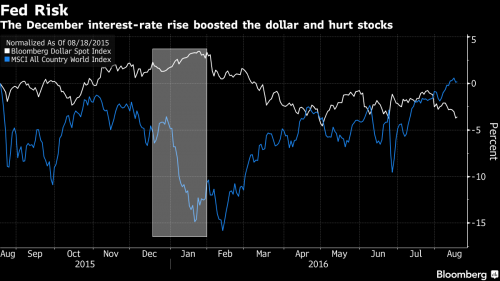

The rebound in the dollar was catalyzed by comments from Fed President William Dudley and Dennis Lockhart who jolted markets yesterday by indicating a rate hike in 2016 remained possible despite uneven growth in the world’s largest economy. Their comments helped push the probability of a Fed move above 50 percent in the futures market for the first time since the June 23 Brexit vote. Before their comments, global equities had climbed to a one-year high and the dollar index sank to levels last seen in May amid conflicting signals over the U.S. labor market and growth.

“A pull-back is following through in European stocks today after the Fed raised the possibility of a September rate hike,†said William Hobbs of Barclays in London. “It seems like expectations had become too muted.â€

Today it will be all abaout the Fed again: Group head of multi-asset portfolios at GAM, Larry Hatheway, said attention was firmly on the Fed minutes and particularly why the bank’s last meeting ended with a notably cautious statement. “It wasn’t really about Brexit. It is not even about the world economy which isn’t in great shape but is somewhat improved from the first quarter fears and its surely not about the cost of capital,” Hatheway said. “So one presumes the caution reflects a thought process about a much lower equilibrium real interest rate …or possibly the fact that inflation is just not accelerating, which was corroborated to a degree by CPI data yesterday.”

But before the Fed we will get another dovish blast as St. Louis Fed chief James Bullard – the Fed’s latest uberdove – is due to speak Wednesday at 1pm, one hour ahead of the Minutes release which are scheduled for release at 2 p.m. in Washington.

In Asia overnight, the MSCI’ Asia-Pacific index ex-Japan dipped 0.3% while Japan’s Nikkei closed 0.9 percent higher, paring some of Tuesday’s sharp losses thanks to a weaker yen as it dropped back below the 100 yen per dollar level. China’s CSI 300 index and the Shanghai Composite both erased earlier losses to end the day flat after authorities approved the launch of a long-awaited scheme to allow stock trading between Shenzhen and Hong Kong.

European yields nudged 2-4 basis point lower with Spanish bonds boosted ahead of a meeting later that could pave the way for a new government in Madrid after eight months of limbo. Interim prime minister Mariano Rajoy is to hold a meeting of his Conservative People’s Party (PP) to consider a reforms-for-support offer from centrist rivals Ciudadanos. “I still have doubts about political progress in Spain and negotiations could still go on for weeks,” said DZ Bank strategist Christian Lenk. “But markets do seem to like what’s coming out of Madrid.

It has been a quiet session in European equities where the Stoxx 600 slipped 0.3% for a fourth day without gains. The volume of Stoxx 600 shares traded was 27% lower than the 30-day average. S&P 500 Index futures were little changed, after U.S. equities fell on Tuesday. ASML Holding NV dragged technology shares to the biggest decline on the equity benchmark, dropping 5 percent after Intel surprised the market when it said it won’t use the semiconductor-equipment maker’s lithography technology to make some of its chips. Carlsberg A/S slid 4.6% after the Danish brewer reported first-half profit that missed analysts’ estimates as the weakness of Russia’s ruble eroded earnings.

The MSCI Emerging Markets Index was down 0.9 percent, trimming this quarter’s advance to less than 9 percent. In Hong Kong, small-cap shares

were the brightest part of China’s stock markets after an exchange trading link between the city and Shenzhen was unveiled. The Hang Seng Composite Small Cap Index climbed 0.5 percent to four-month high.

Tyco International Plc (TYC) and Johnson Controls Inc. (JCI) have shareholder meetings lined up to vote on their proposed $16 billion merger, while Target Corp. and Cisco Systems Inc. are among U.S. companies reporting results.

Market Snapshot

- S&P 500 futures down less than 0.1% to 2176

- Stoxx 600 down 0.3% to 342

- FTSE 100 down 0.1% to 6887

- DAX down 0.8% to 10592

- German 10Yr yield down less than 1bp to -0.04%

- Italian 10Yr yield up 2bps to 1.13%

- Spanish 10Yr yield up 2bps to 1%

- S&P GSCI Index down 0.6% to 360.9

- MSCI Asia Pacific down less than 0.1% to 139

- Nikkei 225 up 0.9% to 16746

- Hang Seng down 0.5% to 22800

- Shanghai Composite down less than 0.1% to 3110

- S&P/ASX 200 up less than 0.1% to 5535

- US 10-yr yield up less than 1bp to 1.58%

- Dollar Index up 0.19% to 94.97

- WTI Crude futures down 0.9% to $46.14

- Brent Futures down 1% to $48.75

- Gold spot down 0.2% to $1,343

- Silver spot down 0.9% to $19.61