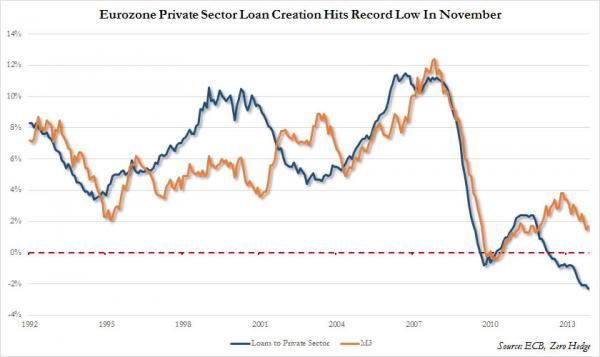

For those who have been following the abysmal loan creation in Europe, which recently dropped to an all time low…

… today’s inflation, or rather make that deflation, data out of Europe should not come as much of a surprise. Then again, with January inflation posting the biggest drop in history, when it tumbled by a record 1.1% from December levels, even the skeptics may be stunned by how rapidly deflation is gripping the continent.

On an anual basis, Euro area inflation rose by 0.8% for the second month in a row and the 4th month of sub 1% annual inflation in a row. At this rate, Europe will enter outright deflation in a few short months.

Broken down by country:

Reuters explains:

Euro zone consumer prices fell in January at their fastest ever pace on a monthly basis, dragged down by a slump in the cost of non-energy industrial goods, keeping annual inflation well below the European Central Bank’s target.

Inflation rate in the 18 countries sharing the euro dropped by 1.1 percent in January when compared with December, keeping the annual inflation rate at 0.8 percent for a second month in a row, the EU’s statistics office Eurostat said.

The annual inflation rate was revised from 0.7 percent, which Eurostat released in a flash estimate on January 31.

Economists polled by Reuters expected consumer price inflation to accelerate slightly to 0.9 percent in January, a level that is still well below the ECB’s target of close to but below 2 percent.

The annual rate was influenced by a 1.2 percent decline in the highly volatile prices of energy, while the monthly decline was hit by a 3.9 percent fall in prices of non-energy industrial goods and a 0.4 percent drop in the price of services.

The ECB, which cut its key interest rate to a record low of 0.25 percent in November, is expected to stay put until mid-2015 unless money market rates rise and the euro strengthens.

…

Italy, the euro zone’s third largest economy, showed a 2.1 percent month-on-month decline, the biggest drop from among all euro zone members.

In Germany, Europe’s largest economy, consumer prices fell by 0.7 percent on the month, keeping the annual inflation rate steady at 1.2 percent, with both figures coming below expectations.